Nigerian Exchange Limited

Ecobank Gained 45 Percent as Stock Investors Pocketed N137 Billion Last Week

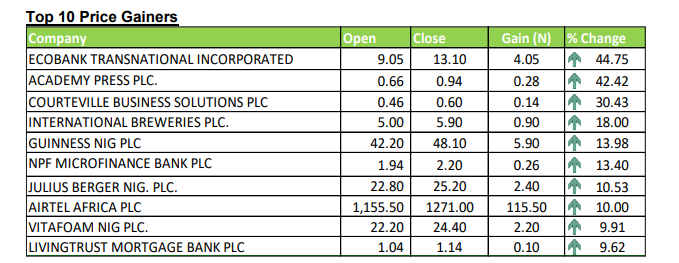

Ecobank closed the week ended January 28th, 2022 with a 44.75 percent gain following the release of its financial statements for the 2021 financial year.

The price of Ecobank’s stocks rose from N9.05 it opened the week to N13.10 a unit immediately the lender announced it grew profit after tax by 324 percent in the period ended December 31, 2021, Investors King reported on Friday.

During the week, investors in the Nigerian Exchange Limited (NGX) transacted 1.448 billion shares worth N19,080 billion in 22,557 deals, against a total of 1.858 billion shares valued at N47.486 billion that were traded in 20,861 deals in the previous week.

Breaking down key industries, the Financial Service Industry led the activity chart with 793.120 million shares valued at N8.151 billion traded in 10,947 deals. Therefore, contributing 54.77 percent and 42.72 percent to the total equity turnover volume and value respectively.

The ICT Industry followed with 215,543 million shares worth N3.740 billion in 1,468 deals. In third place was The Conglomerates Industry, with a turnover of 98.299 million shares worth N190.248 million in 889 deals.

Guaranty Trust Holding Company Plc, Courtville Business Solutions Plc and Chams Plc accounted for a combined 308.076 million shares worth N2.871 billion in 2,225 deals. The three equities, therefore, contributed 21.27 percent and 15.05 percent to the total equity turnover volume and value, respectively.

Market capitalisation of listed equities appreciated further during the week to close at N24.898 trillion, representing a N137 billion or 0.54 percent gain from N24.761 trillion posted in the previous week. While the NGX All-Share Index gained 247.70 index points or 0.55 percent to settle at 46,205.05 index points. The year-to-date return increased to 8.17 percent.

However, all other indices finished lower with the exception of NGX Mainboard, NGX banking, NGX AFR Bank Value, NGX AFR Div Yield, NGX Meri Growth, NGX Consumer Goods and NGX Oil/Gas indices, which appreciated by 3.87 percent, 4.84 percent, 0.35 percent, 1.65 percent, 1.17 percent, 2.04 percent and 3.53 percent while the NGX ASem, and NGX Growth indices closed flat.

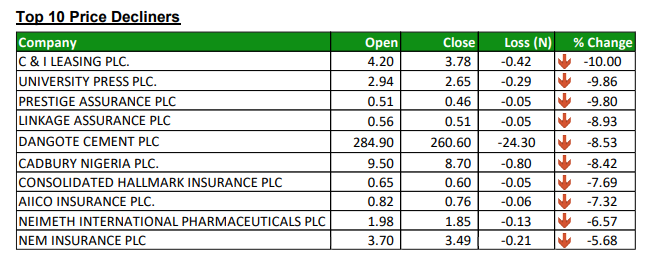

Forty-forty equities appreciated in price during the week, lower than forty-seven equities in the previous week. Thirty-three equities depreciated in price, higher than twenty-three equities in the previous week, while seventy-nine equities remained unchanged lower than eighty-six equities recorded in the previous week.