Nigerian Exchange Limited

Stock Investors Gained N810 Billion Last Week

The Nigerian Exchange Limited (NGX) extended its gain for the third straight week in 2022 as sentiment rose across the Exchange. Investors gained N810 billion last week following N323 billion profit recorded in the previous week.

Investors transacted 1.858 billion shares worth N47.486 billion in 20,861 deals during the week, in contrast to a total of 1.600 billion shares valued at N32.716 billion that exchanged hands in 22,607 deals in the previous week.

The Financial Service Industry led the activity chart with 815.363 million shares valued at N7.066 billion traded in 10,736 deals. Therefore, contributing 43.89 percent and 14.88 percent to the total equity turnover volume and value, respectively. The ICT Industry followed with 596.575 million shares worth N845.020 million in 1,028 deals.

In third place was the Conglomerates Industry, with a turnover of 161.347 million shares worth N191.189 million in 983 deals.

Computer Warehouse Group Plc, Transnational Corporation of Nigeria Plc and FBN Holdings Plc were the three most traded equities. Together accounted for 810.748 million shares worth N2.080 billion that were exchanged in 1,499 deals and contributed 43.65 percent and 4.38 percent to the total equity turnover volume and value, respectively.

The market value of listed equities grew by 3.38 percent or N810 billion from N23.951 trillion in the previous week to N24.761 trillion last week. The NGX All-Share Index expanded by 1,502.68 index points or 3.38 percent to 45,957.35 index points, up from 44,454.67 index points filed in the previous week.

Similarly, all other indices finished higher with the exception of NGX insurance index, which depreciated by 0.27 percent, while the NGX ASem, and NGX Sovereign bond indices closed flat.

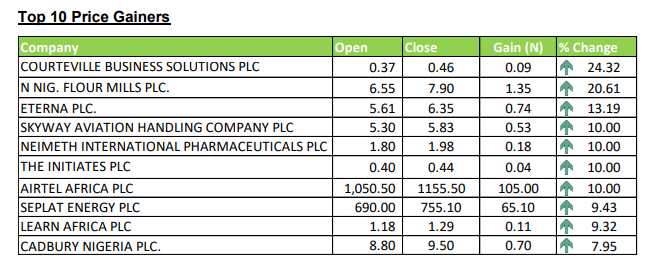

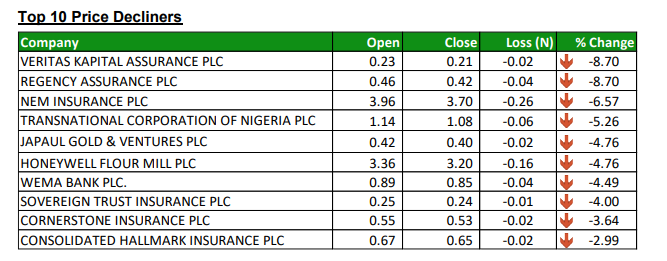

Forty-seven equities appreciated in price during the week, higher than Thirty-three equities in the previous week. Twenty-three equities depreciated in price, lower than Thirtyfive equities in the previous week, while Eighty-six equities remained unchanged lower than Eighty-eight equities recorded in the previous week.

The Exchange year-to-date return stood at 7.59 percent, up from N4.01 percent achieved in the previous week. See other details below.