Nigerian Exchange Limited

Nigerian Stocks Value Appreciates by 5.97 percent in the First Week of the Year

The Nigerian Exchange Limited (NGX) started the year with a strong positive momentum despite the fact that most businesses and investors will just be resuming fully today. The NGX market value grew by 5.97 percent to N23.628 trillion in the four trading days week, while the NGX All-Share Index gained 2.66 percent to settle at 43,854.42 index points.

Investors traded a total of 2.027 billion shares worth N59.014 billion in 15,750 deals last week, in contrast to a total of 995.361 million shares valued at N13.209 billion that exchanged hands in 10,264 deals last week.

In terms of volume traded, the consumer goods industry led the activity chart with 1.255 billion shares valued at N 51.973 billion traded in 2,581 deals. Therefore, contributing 61.90 percent and 88.07 percent to the total equity turnover volume and value respectively. The Financial Services Industry followed with 537.959 million shares worth N4.627 billion in 8,015 deals.

In third place was The ICT Industry, with a turnover of 76.906 million shares worth N704.346 million in 933 deals.

BUA Foods Plc, Wema Bank Plc, and Transnational Corporation of Nigeria Plc were the three most traded stocks last week, accounting for a combined 1.349 billion shares worth N51.253 billion in 1,120 deals and contributed 67 percent and 86.85 percent to the total equity turnover volume and value, respectively.

The Exchange opened the year with a weekly gain of 2.66 percent year-to-date.

Similarly, all other indices finished higher with the exception of NGX Premium, NGX insurance,

NGX AFR Div Yield, NGX Meri Growth, NGX Consumer Goods, NGX Lotus II Indices, which depreciated by 0.47 percent, 0.93 percent, 0.97 percent,0.66 percent, 0.87 percent, and 0.12 percent, respectively while the NGX ASem and NGX Sovereign bond indices closed flat.

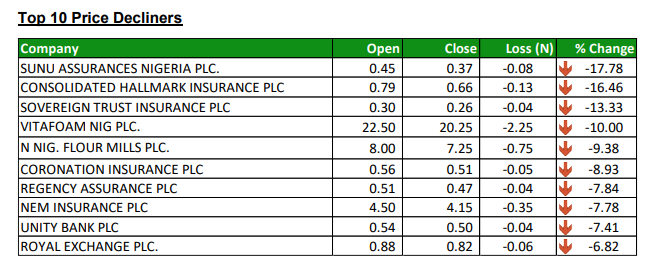

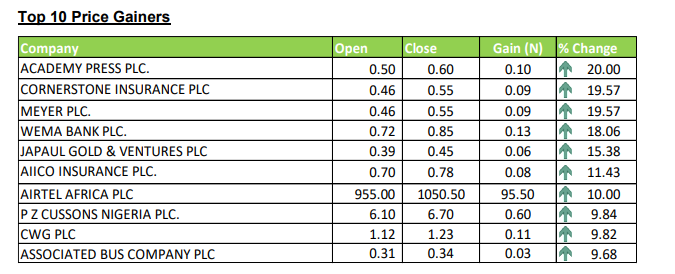

Forty equities appreciated in price during the week, higher than Thirty-seven equities in the previous week. Thirty-one equities depreciated in price, higher than Twenty-one equities in the previous week, while Eighty-four equities remained unchanged compared to ninety-nine equities recorded in the previous week.