Fintech

African Startups Secured $4.69 Billion Funding In 2021 – African Investment Report

African Investment Report released by Briter Bridges showed that African Startups secured $4.69 billion in estimated funding in 2021, out of which $4.65 billion was disclosed and $300 million undisclosed (not comprehensive, based on data provided by investors to Briter Intelligence).

Dario Giuliani, director of Briter Bridges said, “As the world learns to integrate COVID-19 into daily routine, work is retrieving as usual and interest in harnessing the business potential in Africa proves to be stronger and more intentional than it’s been in the past.

“2021 was a year of recognition, where the newly-available resources and the increasing number of international investors shifting mandates to include Africa met hundreds of promising entrepreneurs to support”.

“Approaching $5 billion in known funding in 2021, especially after nearly twenty-four months since COVID-19 pandemic began is a clear sign that Africa is undergoing tangible changes and the increasing presence of local exits and returns is shaping the continent’s attractiveness”. He added.

The top 4 African countries where the startup funding was focused are, Nigeria, South Africa, Kenya and Egypt.

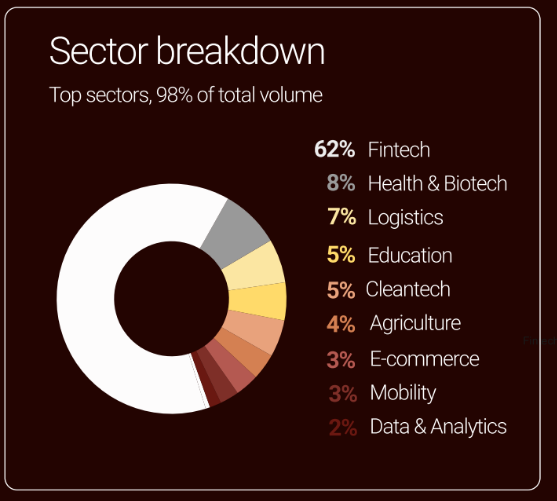

The report further revealed that financial technology companies captured the largest share of funding on the African continent, gulping 62 percent of the total funding. Breaking down the funding into sectors, Health and Biotech secured 8 percent of the funding, 7 percent to Logistics, 5 percent to Education, 4 percent to Cleantech, 4 percent to Agriculture, 3 percent to E-commerce, 3 percent to Mobility and 2 percent to Data and Analytics.

In 2021, 13 companies raised $100 million in a single round. Some of the companies are Opay, Chipper, Flutterwave, Andela, and others. The report also showed that debt financing companies captured 6 percent of total disclosed funding in 2021.

Africa’s startup Merger and Acquisition market also recorded significant growth in 2021. The African Investment Report showed that 33 acquisition was recorded in 2021 compared to 17 acquisition deals reported in 2020.

The report further revealed that a large sum of the fund disbursed in Africa’s market is from the United States and the United Kingdom. The United States accounts for 62.5 percent of the fund, 7.5 percent from the United Kingdom, 6 percent from South Africa, 4 percent from Canada and 20 percent from others.

The report stated, “the growing investment appetite towards Africa’s entrepreneurs has resulted in the rise of corporate venture funds and corporate innovation initiatives interested in harnessing the skills, networks and technologies developed by local companies in a variety of sectors”.