Nigerian Exchange Limited

Nigerian Stock Market Closed 2021 Strong, Gained 1.07 Percent Last Week

The Nigerian Exchange Limited (NGX) posted a strong gain in the last week of 2021 to extend the year-to-date return to 6.07 percent.

In the three-day trading week, investors exchanged 995.361 million shares worth N13.209 billion in 10,264 transactions, in contrast to a total of 965.061 million shares valued at N12.455 billion that exchanged hands in 14,802 deals in the previous week.

The Financial Services Industry led the activity chart with 843.972 million shares valued at N5.885 billion traded in 5,925 deals; thus contributing 84.79 percent and 44.55 percent to the total equity turnover volume and value, respectively. The Conglomerates Industry followed with 46.815 million shares worth N166.702 million in 368 deals.

In third place was The Construction/Real Estate Industry, with a turnover of 27.276 million shares worth N107.509 million in 315 deals.

Jaiz Bank Plc, FBN Holdings Plc, and Zenith Bank Plc accounted for 348.887 million shares worth N 3.4193 billion in 1,552 deals. Therefore, contributed 35.05 percent and 25.88 percent to the total equity turnover volume and value, respectively.

The NGX All-Share Index appreciated by 453.59 index points or 1.07 percent to close the week at 42,716.44 index points, up from 42,262.85 index points. While the market value of all listed equities gained 1.07 percent to settle at N22.297 trillion.

Similarly, all other indices finished higher with the exception of NGX Main Board, NGX Oil/Gas and NGX Industrial Goods Indices which depreciated by 0.84 percent, 1.09 percent and 3.91 percent, respectively while the NGX ASeM Index closed flat.

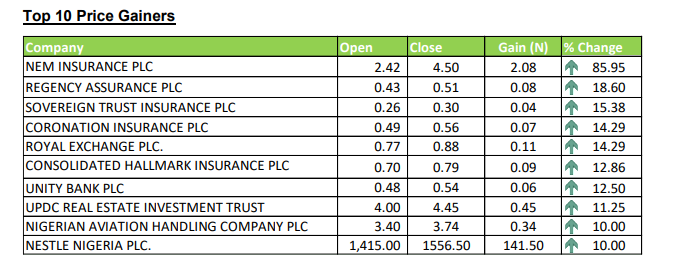

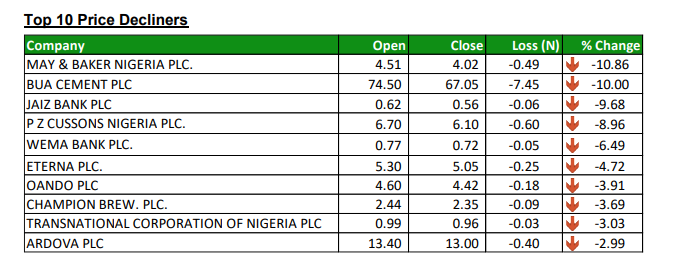

Thirty-seven equities appreciated in price during the week, higher than Thirty-three equities in the previous week. Twenty-one equities depreciated in price, lower than Twenty five equities in the previous week, while ninety-nine equities remained unchanged similar to ninety-nine equities recorded in the previous week. See top gainers and losers below.