Nigerian Exchange Limited

Nigerian Stock Investors Gained N253 Billion Last Week

Investors in the Nigerian Exchange Limited (NGX) gained N253 billion last week on the back of a strong renewed interest in the Exchange going into the new year.

Investors exchanged 1.317 billion shares worth N15.330 billion in 18,292 deals last week, in contrast to a total of 2.630 billion shares valued at N26.900 billion that exchanged hands in 20,848 transactions in the previous week.

The Financial Services Industry led the activity chart with 899.768 million shares valued at N7.325 billion traded in 9,326 deals. Therefore, contributing 68.32 percent and 47.78 percent to the total equity turnover volume and value, respectively. The Consumer Goods Industry followed with 209.502 million shares worth N2.796 billion in 2,866 deals.

In third place was The Conglomerates Industry, with a turnover of 93.813 million shares worth N663.135 million in 485 deals.

FBN Holdings Plc, International Breweries Plc and Access Bank Plc were the three most traded equities during the week, accounting for a combined 469.879 million shares worth N4.170 billion in 1,958 deals and contributed 35.68 percent and 27.20 percent to the total equity turnover volume and value respectively.

Market capitalisation of listed stocks gained 1.16 percent or N253 Billion to N22.107 trillion last week while the NGX All-share index appreciated by 1.12 percent to close at 42,353.31 index points.

Similarly, all other indices finished higher with the exception of NGX Main Board, NGX Banking, NGX AFR Bank Value, NGX AFR Div Yield, NGX MERI Growth and NGX Oil/Gas indices which depreciated by 0.22 percent, 1.82 percent, 2.23 percent, 0.08 percent, 0.85 percent and 0.57 percent respectively. While the NGX ASeM, NGX Growth and NGX Sovereign Bond Indices closed flat.

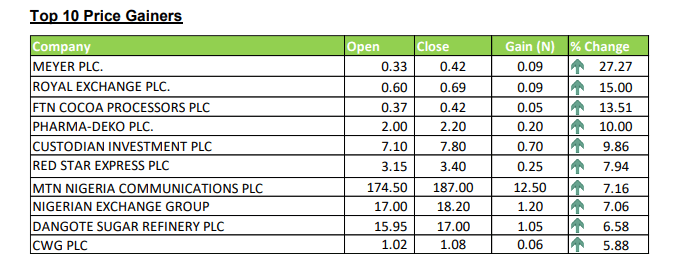

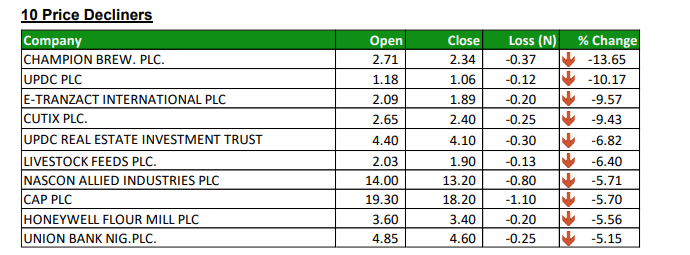

Thirty-two equities appreciated in price during the week, lower than thirty-five equities in the previous week. Twenty-eight equities depreciated in price, higher than twenty-seven equities in the previous week, while ninety-six equities remained unchanged higher than ninety-four equities recorded in the previous week. See top gainers and losers for the week.