Nigerian Exchange Limited

NGX-ASI Depreciates by 0.68 Percent Last Week as 27 Equities Closed in Red

The Nigerian Exchange Limited (NGX) All-Share Index sheds 0.68 percent to extend its decline to 41,882.97 index points last week.

Investors exchanged a total of 2.630 billion shares worth N26.900 billion in 20,848 deals, in contrast to a total of 1.278 billion shares valued at N17.340 billion that were exchanged in 21,052 deals in the previous week.

The Financial Services Industry led the activity chart with 2.234 billion shares valued at N21.449 billion traded in 11,482 deals. Therefore, contributing 84.95 percent and 79.73 percent to the total equity turnover volume and value, respectively. The Services Industry followed with 157.089 million shares worth N695.798 million in 465 deals.

In third place was The Consumer Goods Industry, with a turnover of 71.016 million shares worth N1.708 billion in 3,019 deals.

FBN Holdings Plc, Sterling Bank Plc and C & I Leasing Plc accounted for 1.607 billion shares worth N14.751 billion in 1,646 deals, contributing 61.13 percent and 54.84 percent to the total equity turnover volume and value, respectively.

The market value of all listed equities dipped by N149 billion from N22.003 trillion recorded in the previous week to N21.854 trillion last week.

All other indices finished higher with the exception of NGX 30, NGX Premium, NGX Lotus II and NGX Industrial Goods indices which depreciated by 0.54 percent, 2.25 percent, 1.31 percent and 5.42 percent respectively while the NGX ASeM, NGX AFR Div Yield, and NGX Sovereign Bond Indices closed flat.

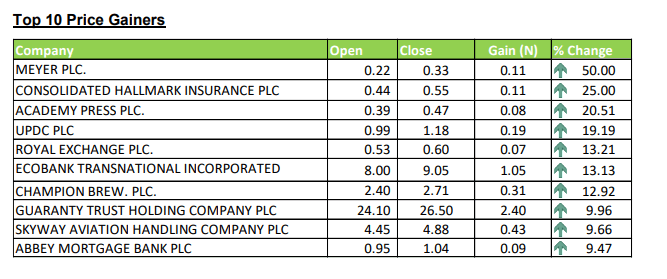

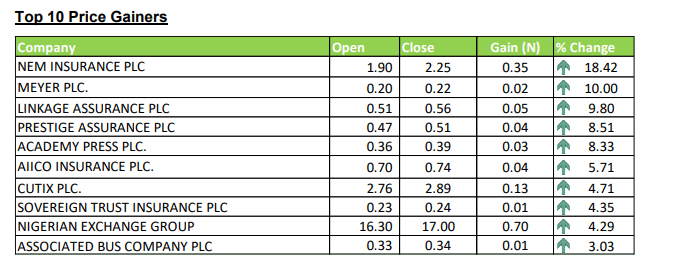

Thirty-five equities appreciated in price during the week, higher than eighteen equities in the previous week. Twenty-seven equities depreciated in price, lower than forty-nine equities in the previous week, while ninety-four equities remained unchanged higher than eighty-nine equities recorded in the previous week. The Exchange’s year to date gain moderated further to 4 percent.