Nigerian Exchange Limited

NGX All-Share Index Declined Last Week, Market Value Sheds N18 Billion

The Nigerian Exchange Limited (NGX) All-Share Index depreciated by 53.74 index points or 0.12 percent to 43,199.27 index points last week. Moderating the year-to-date return from 7.41 percent achieved in the previous week to 7.27 percent last week.

Market value of all listed stocks dipped by N18 billion to N22.554 trillion, down from N22.572 trillion recorded in the previous week.

Investors transacted 1.392 billion shares worth N27.886 billion in 19,990 deals last week, against a total of 1.471 billion shares valued at N20.941 billion that exchanged hands in 20,410 transactions in the previous week.

In terms of volume traded, the Financial Services Industry led the activity chart with 1.082 billion shares valued at N11.579 billion traded in 11,612 transactions. Therefore, contributing 77.72 percent and 41.52 percent to the total equity turnover volume and value, respectively.

The Consumer Goods Industry followed with 105.796 million shares worth N11.831 billion in 2,657 deals. In third place was the Conglomerates Industry, with a turnover of 56.136 million shares worth N73.687 million in 575 deals.

FBN Holdings Plc, Guaranty Trust Holding Company Plc and Sterling Bank Plc were the most traded equities, accounting for 638.319 million shares worth N8.542 billion that were transacted in 4,116 deals. The three contributed a combined 45.85 percent and 30.63 percent to the total equity turnover volume and value, respectively.

Similarly, all other indices finished lower with the exception of NGX-Main Board and NGX Sovereign Bond indices which appreciated by 0.41 percent and 1.40 percent respectively, while the NGX ASeM and NGX Growth Indices closed flat.

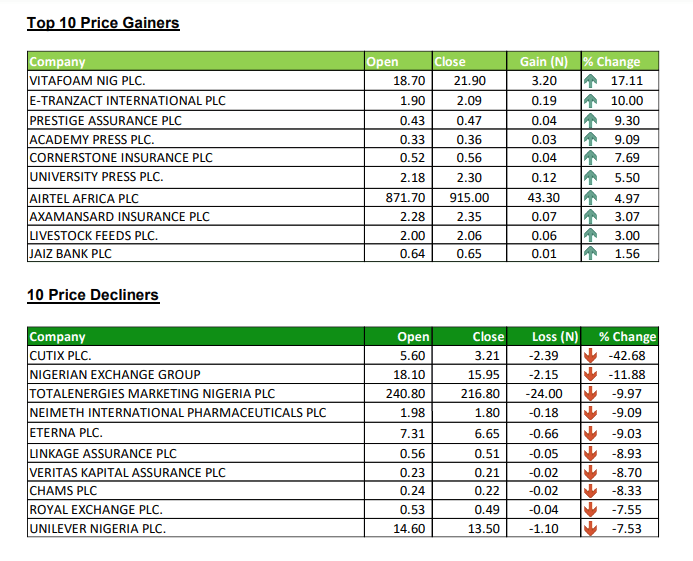

Last week, fifteen equities appreciated in price, lower than Twenty-seven equities in the previous week. Forty-nine equities depreciated in price, higher than Thirty-six equities in the previous week. While ninety-two equities remained unchanged lower than ninety-three equities recorded in the previous week.