Ethereum

Ethereum Could Hit $8,000 In the Next Two Months – Goldman Sachs

The American multinational investment bank and financial services, Goldman Sachs, has predicted that the price of Ethereum could hit $8,000 by the end of 2021. This prediction was reported in a research note circulated by Bernhard Rzymelka, the managing director of Global Market at Goldman Sachs.

According to Zerohedge, the research note explained in detail how cryptocurrency trading has corresponded with inflation breakevens since 2019.

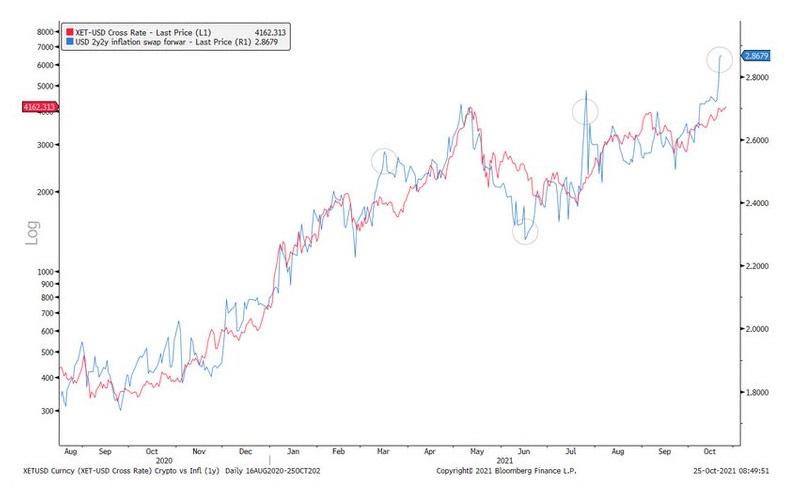

Referencing a chart showing the Bloomberg Galaxy Crypto Index (red) on a log axis and the USD 2-year forward 2-year inflation swap (blue), Goldman’s analysts noted that “the local backdrop looks supportive for ethereum.”

The analysts said: “It has tracked inflation markets particularly closely, likely reflecting the pro-cyclical nature as ‘network based’ asset. And the lastest spike in inflation breakevens suggests upside risk if the leading relationship of recent episodes was to hold (grey circles).”

They further pointed out that: “This lines up well with the ethereum chart.”

The Investment bank analyst further asserted that: “The market has started to press against the all-time high with a narrowing wedge: Either a sign of exhaustion and peaking … or a starting point of an accelerating rally upon a break higher.” The analyst also noted that “the RSI has yet to hit the overbought levels seen in past market highs.”

According to the research note, if the historical correlation between cryptocurrencies trading and inflation persists, there is a high probability for ethereum price to surge as high as $8,000 in the next two months.

In a recent price prediction by Finder.com, a panel of 50 fintech specialists predicts the price of Ethereum to hit $5,114 by end of 2021, $15,364 by 2025 and $50,788 by the end of 2030.

At press time, Ethereum (ETH) is trading for $4,475 with over $528 billion market capitalization. Ethereum has gained 7.63 percent in the last 7 days and 2.60 percent in the last 24 hours.

Goldman Sachs formally established a crypto trading team and launched bitcoin derivatives trading in May. In the following month the bank’s head of digital assets, Mathew McDermott, revealed plans to offer futures and options trading in Ethereum (ETH) in the coming months.