Fintech

FirstBank Fintech Summit 5.0: How Open Banking Can Address Market Frictions, Grow Nigeria’s GDP to $3 Trillion by 2035 – Ndubuisi Ekekwe

Professor Ndubuisi Ekekwe, the Chairman of FASMICRO Group and the lead Faculty in Tekedia Institute, on Thursday discussed how financial institutions can use open banking access to address market frictions, improve the standard of living, further economic productivity and transform the Nigerian society into an innovative society.

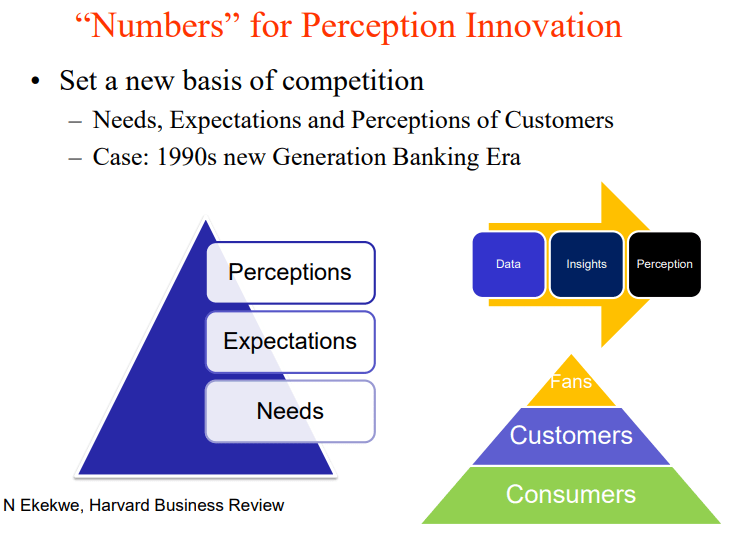

Speaking at the virtual FirstBank Fintech Summit 5.0 on Open Banking: The Grand Unification of Application Utility Age, Prof. Ekekwe posited that if according to Pythagoras the world is made up of numbers, then ‘it means the business of humanity is nothing but the business of numbers’. Meaning, if a doctor understands the numbers around the human system, he/she will become a better doctor, it is the same for banks and other businesses. Therefore, the quest to getting better in any industry or society is to build a solid data system that allows operators to better understand the numbers around that industry or society.

The Prof break this down by using the inherent imperfect market systems that impede big businesses from understanding the needs of those in the rural areas, therefore, making it impossible to profer solutions that could help further these companies’ missions and visions, fast track their growth and help humanity at large.

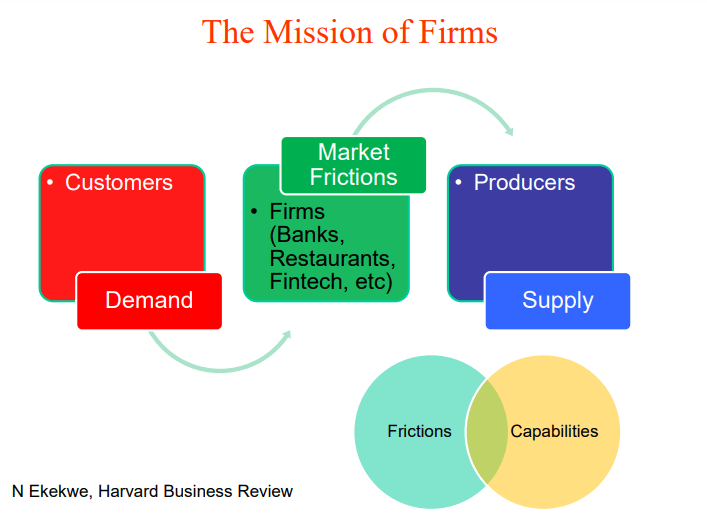

Using a chart titled ‘the Mission of Firms’, Prof Ekekwe stated that because the demand knows something that supply does not know and vice versa, it is cogent for businesses to acquire capabilities that enable them to bring demand and supply to an equilibrium point where supply can succinctly address demand.

Banks, Restaurants, Fintechs, etc must acquire capabilities that help them understand societal needs before they can profer solutions necessary to make transactions happen. Professor Ekekwe cited the bank’s position as a depository and also a lender, this he said makes it possible for borrowers willing to pay a certain percentage as an interest to approach banks for loans while those not presently in need of their money can equally deposit it in the bank for a fraction of the interest paid by borrowers. By addressing this market friction, the bank was able to make transactions happen, support borrowers’ business and satisfy the need of depositors.

However, because companies that only serve the needs of customers will never be great. It is important to understand not just customers’ needs but expectations and perceptions. This, Prof Ekekwe said can be achieved through the insights provided by the improved data of open banking, saying open banking offers promise to have a better insight into the future of customers.

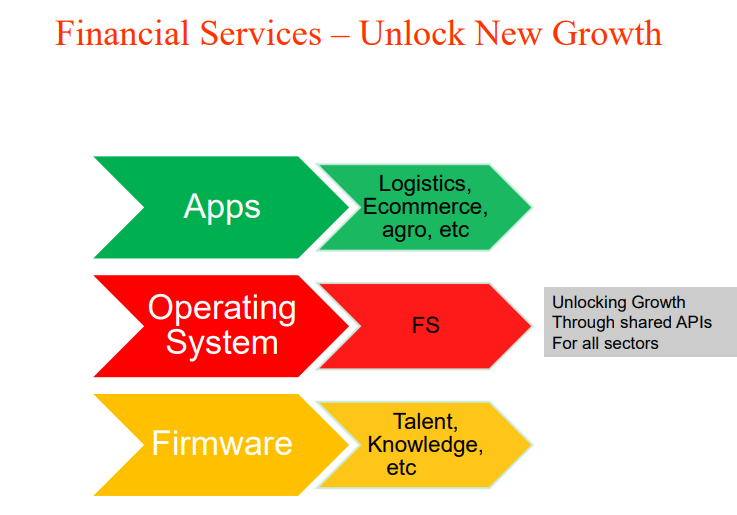

Therefore, to unlock new growth, financial services providers must become an operating system through shared APIs for all sectors. More data will translate to better insights and more market opportunities that could bolster Nigeria’s Gross Domestic Product (GDP) to $3 trillion by 2035 as other companies will have access to those customers through APIs.

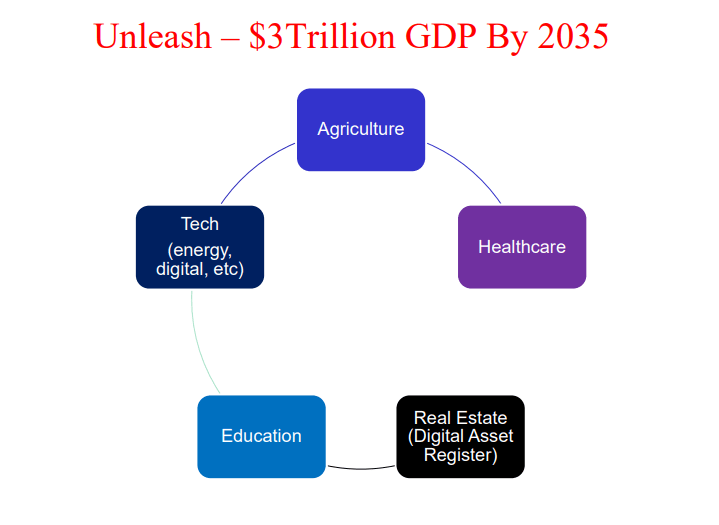

Using the chart below, Prof Ekekwe revealed how banks can access data from all sectors through Open Banking innovation and use this information to understand what businesses and customers in the agriculture, healthcare, technology, real estate and education sectors expect of them.

According to him, the knowledge system the bank can acquire from open banking ordinance will not only affect the financial services but also have the capability to impact mortgage business, real estate business and other businesses in our society.

He further stated that the effective implementation of open banking will increase available opportunities in each sector by a factor of six, bolstering Nigeria’s GDP to $3 trillion by 2035. Explaining how this can be achieved, he said banks and other businesses with data from APIs will be able to expand their offerings by understanding the needs of those in the rural areas, therefore, sharing progress and prosperity in abundance across rural regions.

Bringing it all together, open banking takes banks beyond financial services to become Operating System (OS) of economies by providing retail customers with necessary analytics, viable credit systems that provide insights into their activities and encourage intelligent lending while Small and Medium Enterprises (SMEs) would have an integrated tax and accounting interface that empowers them to understand their own business, cashflow and deposit better.

Other sectors like real estate, Oil and Gas, etc perform better with Open Banking, and even compliance with regulatory guidelines become better and improve with a well-thought-out and executed open banking architecture. This, Professor Ekekwe concluded would transform Nigerian society into an innovative society.