Nigerian Exchange Limited

Stock Market Returns to Bullish Trend, Gained N11 Billion Last Week

The Nigerian Exchange Limited (NGX) returned to the green zone last week following two consecutive weeks of decline.

Investors exchanged 856.289 million shares worth N10.752 billion in 15,663 deals during the week, in contrast to a total of 1.426 billion shares valued at N13.073 billion that exchanged hands in 19,315 transaction in the previous week.

In terms of volume traded, the financial services industry led the activity table with 583.038

million shares valued at N3.971 billion traded in 7,894 deals. Therefore, contributing 68.09 percent and 36.93 percent to the total equity turnover volume and value, respectively.

In the second place was the consumer goods industry that followed with 62.961 million shares worth N3.197 billion that were traded in 2,579 deals. The ICT Industry came third with a turnover of 45.745 million shares worth N1.646 billion in 775 transactions.

Access Bank Plc, Universal Insurance Plc and Wema Bank Plc were the three most traded stocks last week, accounting for a combined 211.151 million shares worth N789.843 million in 1,403 deals and contributed 24.66 percent and 7.35 percent to the total equity turnover volume and value, respectively.

NGX All-share Index gained 22.09 index points or 0.06 percent to 38,943.87 index points last week, up from 38,921.78 it traded in the previous week. The market value of all listed equities expanded by N11 billion or 0.05 percent from N20.279 trillion it closed in the previous week to N20.290 trillion last week.

Similarly, all other indices finished higher with the exception of NGX Banking, NGX Insurance, NGX MERI Growth, NGX Consumer Goods, NGX Oil/Gas and NGX Industrial Goods indices which depreciated by 0.79 percent, 0.58 percent, 0.12 percent, 0.21 percent, 3.35 percent and 0.24 percent, respectively. While the NGX ASeM, NGX Growth and NGX Sovereign Bond Indices closed flat.

The Exchange has now gained 2.73 percent in the third quarter but declined by 0.70 percent in month of September to bring year to date return to – 3.29 percent.

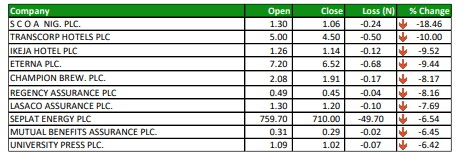

Top 10 Price Decliners