Nigerian Exchange Limited

Equities Investors Lose N63 Billion Last Week

The Nigerian Exchange Limited (NGX) returned to bearish last week despite strong second-quarter reports from listed companies.

Investors traded total shares of 1.374 billion worth N11.823 billion in 22,982 transactions last week, against a total of 896.174 million shares valued at N5.235 billion that exchanged hands in 11,714 deals in the previous week.

In terms of volume traded, the financial services industry led the activity chart with 715.394 million shares valued at N4.745 billion traded in 10,274 deals. Therefore, contributing 52.06 percent and

40.13 percent to the total equity turnover volume and value, respectively.

The Conglomerates Industry followed with 212.340 million shares worth N517.613 million in 1,060 deals. The third place was Oil and Gas Industry, with a turnover of 153.440 million shares worth N1.597 billion in 3,076 deals.

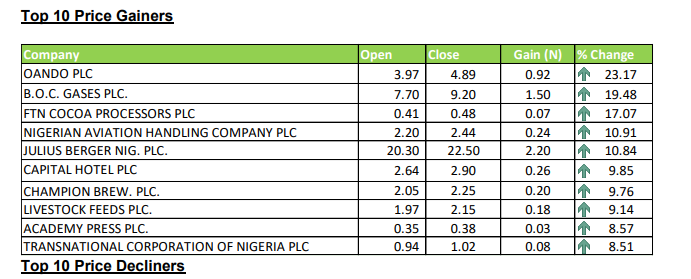

Transnational Corporation Of Nigeria Plc, Oando Plc and Fidelity Bank Plc were the three most traded equities during the week. The three accounted for 378.863 million shares worth N995.477 million in 2,998 deals, therefore, they contributed a combined 27.57 percent and 8.42 percent to the total equity turnover volume and value, respectively

The NGX All-Share Index declined by 0.31 percent or 120.82 index points from 38,667.90 index points posted in the previous week to 38,547.08 index points last week.

Similarly, market capitalization depreciated by 0.31 percent or N63 billion to close at N20.084 trillion last week, down from N20.147 trillion.

All other indices finished lower with the exception of NGX Premium, NGX Consumer Goods, NGX Oil/Gas and NGX Sovereign Bond indices which appreciated by 0.02 percent, 0.06 percent, 3.84 percent and 1.97 percent respectively, while the NGX ASeM and NGX Growth Indices closed flat.