Nigerian Exchange Limited

Nigerian Stock Exchange Depreciates Further Last Week

Stocks continue to decline across the board in Africa’s largest economy last week as investors’ cashout grows with rising yield.

Investors traded a total turnover of 2.342 billion shares valued at N19.272 billion in 20,173 deals during the week, against a total of 1.675 billion shares worth N23.541 billion that exchanged hands in the previous week in 21,732 transactions.

The financial services industry led in terms of volume traded with 1.888 billion shares valued at N12.446 billion and exchanged in 12,019 deals, therefore, the sector contributed 80.60 percent and 64.58 percent to the total equity turnover volume and value, respectively.

This was followed by the natural resources industry with 201.260 million shares worth N41.295 million traded in 27 deals.

In third place was conglomerates goods industry with a turnover of 62.053 million shares worth N65.672 million in 612 deals.

The three most traded stocks were Unity Bank Plc, Guaranty Trust Bank Plc and Multiverse Mining and Exploration Plc, together the three accounted for 1.471 billion shares worth N7.114 billion in 2,317 deals, therefore, contributed 62.82 percent and 36.91 percent to the total equity turnover volume and value, respectively.

Market value of all listed stocks declined by 0.69 percent or N139 billion to close at N20.082 trillion, down from the N20.221 trillion record in the previous week.

Similarly, the NSE All-Share Index declined by 0.69 percent or -266.09 basis points from 38,648.48 basis points posted in the previous week to 38,382.39 basis points last week.

Year to date, the bourse declined by 4.69 percent with 3.56 percent of that decline happening in March alone.

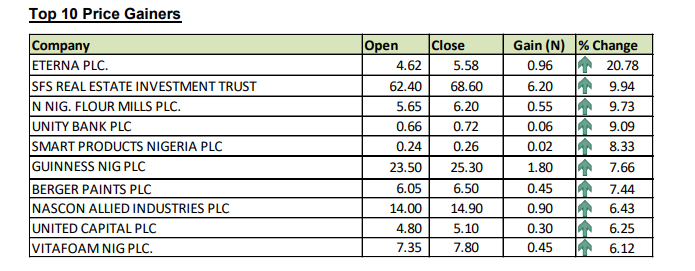

Eternal Plc led the gainers with 20.78 percent, this was followed by SFS Real Estate Investment Trust with 9.94 percent. See the details below.