Stock Market

Zoom Shares Plunge Despite Strong Earnings Report

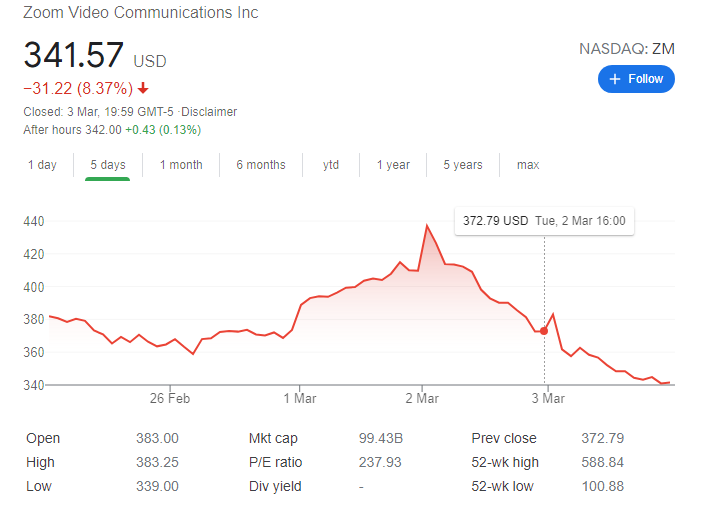

Zoom’s Share Price Plunge to $341.57 as Investors Dumps Holdings

Zoom Shares plunged on Wednesday despite a strong fourth-quarter earnings report filed on Monday.

The video calling software maker posted earnings per share of $1.22, against 79 cents per share predicted by analysts.

Revenue stood at $882.5 million, more than the $811.8 million expected by analysts, according to Refinitiv.

On a yearly basis, revenue grew by 369 percent in the fourth quarter that ended Jan.31, 2021, slightly more than the 367 percent increase recorded in the previous quarter. Thanks to lockdown that forced many people to adopt Zoom globally following the COVID-19 outbreak in China.

The company expanded its gross margin from 66.7 percent achieved in the third quarter to 69.7 percent in the fourth quarter. The slight increase was as a result of the drop in audio usage due to the holidays, stated Kelly Steckelberg, Finance Chief, Zoom.

Zoom ended the fourth quarter with $4.24 billion in cash, cash equivalents and marketable securities, up from $1.87 billion recorded in the third quarter.

According to Steckelberg, the company is looking to acquire companies with its huge cash, however, she said “We just haven’t quite found the right match yet.”

The company added 467,100 customers with more than 10 employees during the period under review. That represents a 470 percent increase over the same quarter of last year.

1,644 customers contributed $100,000 in trailing 12 months revenue, up approximately 156 percent increase from the same period of last year.

Why Zoom Shares Plunge Despite Strong Performance

Global investors are no longer keen on Zoom shares given the slow down in the COVID-19 crisis and better COVID-19 vaccine distribution. Stock investors are predicting a slow down in growth in 2022 fiscal year, especially with businesses reopening and people expected to resume normal operations later in 2021.

Also, the company’s projection for the 2022 fiscal year revealed that management only sees 42 percent growth in revenue to $3.77 billion and adjusted earnings per share of $3.62, an 8 percent increase, against the 326 percent increase in revenue posted in 2021 fiscal year.

Zoom’s share price plunged from $437.01 on Tuesday to $341.57 on Wednesday as investors continue to whine down on their holdings.

Eric Yuan, the company founder and Chief Executive Officer, remains optimistic ahead of 2022.

He said, “As we enter FY2022, we believe we are well-positioned for strong growth with our innovative video communications platform, on which our customers can build, run, and grow their businesses; our globally recognized brand; and a team ever focused on delivering happiness to our customers.”