Nigerian Exchange Limited

Stock Investors Lose N203 Billion Last Week

Stock Investors Lose N203 Billion Last Week

Investors in the Nigerian Stock Exchange lost N203 billion last week as the downward trend continues across the board.

Investors traded 1.930 billion shares worth N20.656 billion in 24,687 deals during the week, against a total of 1.541 billion shares valued at N18.235 billion that exchanged hands in the previous week in 22,752 transactions.

In terms of volume traded, the Financial Services Industry led the activity chart with 1.450 billion shares valued at N15.070 billion traded in 14,236 deals, therefore, contributing 75.11 percent and 72.96 percent to the total equity turnover volume and value, respectively.

This was followed by the Conglomerates Industry with 154.906 million shares worth N179.673 million and in 798 transactions.

In the third place was Consumer Goods Industry, with a turnover of 111.782 million shares worth N2.270 billion in 3,865 deals.

During the week, the three most traded equities were the Wema Bank Plc, Zenith Bank Plc and First Bank Holding Plc, the three accounted for a combined 782.167 million shares valued at N8.914 billion and exchanged in 4,624 deals.

The three most traded equities contributed 40.52 percent and 43.15 percent to the total equity turnover volume and value, respectively.

The NSE All-Share Index depreciated by 0.96 percent or 386.81 index points from 40,186.70 index points recorded in the previous week to close at 39,799.89 index points last week.

While market valued of listed equities also dipped by 0.96 percent or N203 billion from N21.026 trillion in the previous week to N20.823 trillion last week.

All indices closed lower with the exception of NSE Banking, NSE AFR Bank Value, NSE MERI Growth and NSE Oil/Gas Indices which rose by 0.69 percent, 1.34 percent, 0.66 percent and 0.97 percent while the NSE ASeM and NSE Growth Indices closed flat.

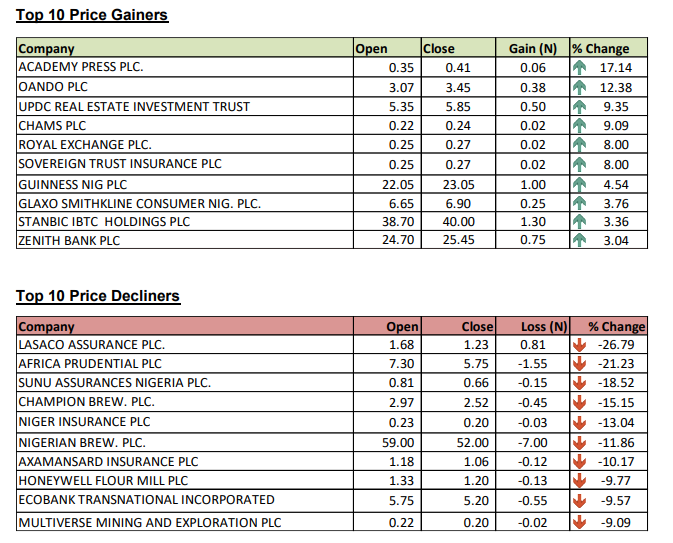

On a monthly basis, the bourse declined by 6.16 percent and 1.17 percent year-to-date. See top gainers and losers below.