Bitcoin

Hedge Funds, Institutional Investors Push Bitcoin Towards $60,000 Per Coin

Bitcoin Approaches $60,000 Per Coin Amid Surge in Demand by Institutional Investors

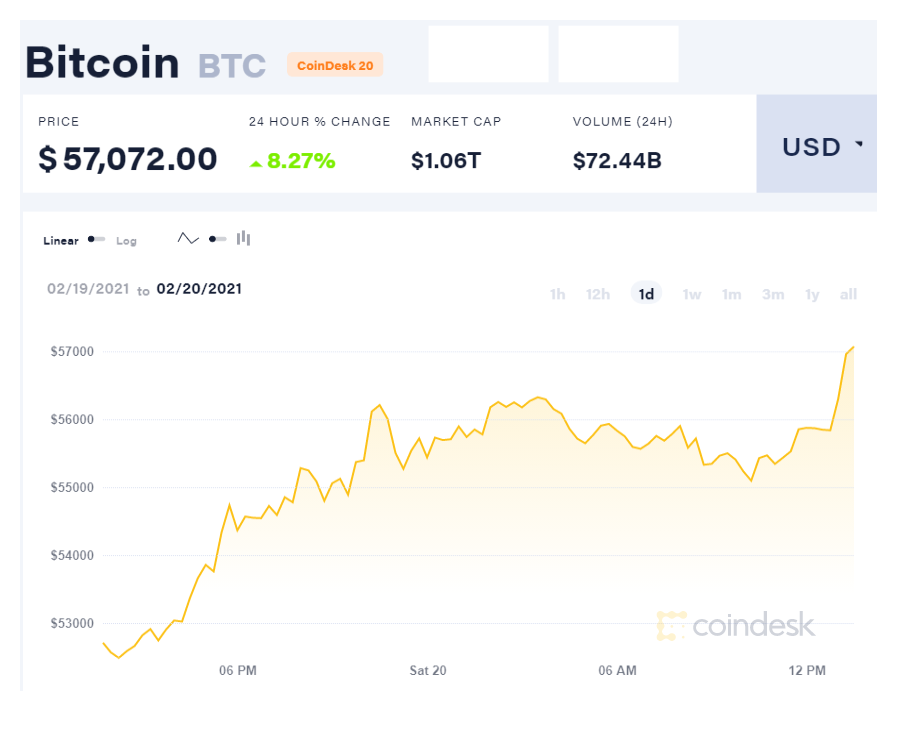

Bitcoin sustained its bullish run on Saturday as the world’s most capitalised cryptocurrency blasted through $57,000 per coin to set a new all-time record at $57,072 per coin.

The dominant cryptocurrency gained 8.27 percent or $4,354.18 in the last 24 hours as more institutional investors and hedge funds jump on the fast-running digital asset to hedge against inflation and economic uncertainty.

The rising demand for the world’s digital gold has now outpaced its supply according to experts.

The rising demand for the world’s digital gold has now outpaced its supply according to experts.

“Through the insatiable buy-side pressure from exchange-traded fund (ETF) issuers, closed-end funds and large public corporations adding bitcoin to their positions, demand is massively outstripping supply,” said John Willock, chief executive at digital asset exchange Blocktane. “I feel confident that we won’t see a massive crash like post-2017.”

The year-to-date returns rose to 90.36 percent. While investors transacted bitcoin worth $15.93 billion in 340,244 transactions at an average transaction fee of $26.40 in the last 24 hours.