Ethereum

Ethereum Extends its 2021 Returns to 170 Percent

Ethereum Extends its 2021 Returns to 170 Percent

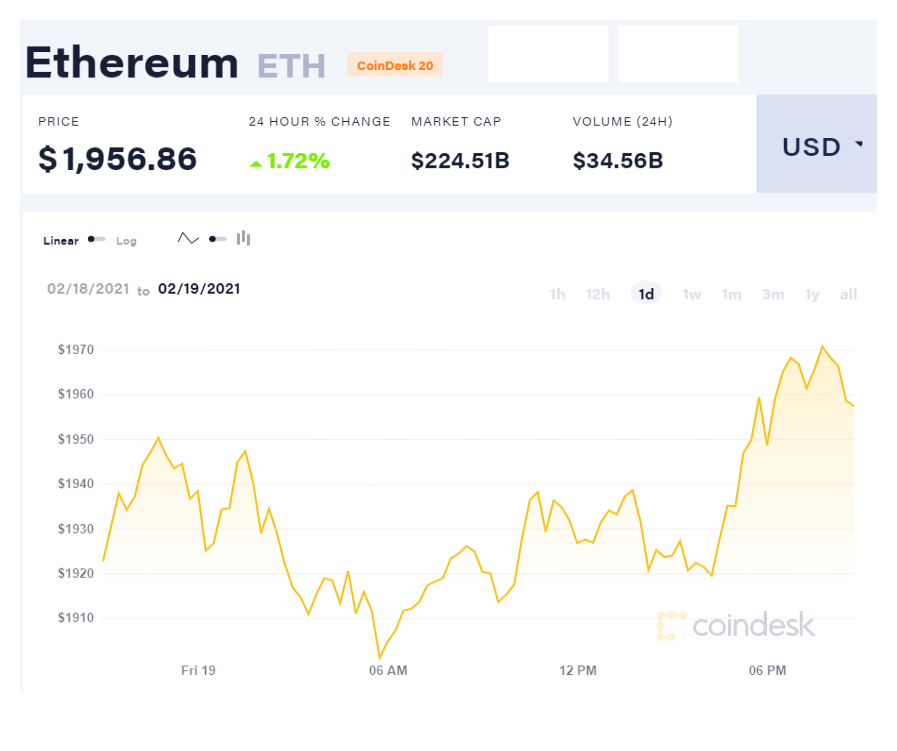

Ethereum, the world’s second most capitalised cryptocurrency, rose by 2.01 percent in the last 24 hours to extend its 2021 returns to 169.76 percent.

Ethereum rose by $31.60 or 2.01 percent from $1,893.21 per coin it opened to $1,922 per coin on Friday.

Investors traded Ethereum valued at $11.09 billion in 1.30 million transaction count at an average transaction fee of $21.44 in the last 24 hours.

The world’s second most valued cryptocurrency has enjoyed a huge surge in capital inflow since Bitcoin took off in the final quarter of last year.

Ethereum was trading at $390.87 per coin as of August 2020 when Investors King predicted its long-term bullish run for the coin.

Read Why I am Bullish on Ethereum Despite Global Uncertainty

On January 4th, 2021, it broke the $1000 resistance level and since then it has risen by 97 percent to take its total return since January 1st, 2021 to 170 percent.

Institutional investors are behind Ethereum’s rising value, according to various cryptocurrency reports.

“Since Grayscale Ethereum Trust (ETHE) just bought over 197,890 ETH worth $344 million on behalf of its investors in a span of two weeks, we are witnessing an influx of investments in ether only a few months after bitcoin’s institutional influx,” F2Pool’s Mao told CoinDesk.

Also, the surged in demand for Defi, Decentralised Finance, powered with the Ethereum blockchain is aiding Ethereum bullish run. Presently, the total value locked in Defi stood at $41.8 billion. Twice of its January value.

“Ether approaching $2,000 could be seen as validation of all the dapps and use cases that have blossomed over the years – from DeFi to NFTs,” OKCoin’s Lau said, referring to nonfungible tokens. “It is also benefiting strongly from bitcoin’s increased adoption. The ratio of ether to bitcoin remains at 2%-4%, a range that has persisted since September 2018.”