Economy

FG to Receive Another $1.5 Billion Loan Following World Bank Approval

World Bank Approves $1.5 Billion New Facility for Nigeria

The World Bank has approved a $1.5 billion loan request submitted by the Federal Government of Nigeria on Tuesday, according to the multilateral financial institution.

The new facility was granted in partnership with the International Finance Corporation (IFC) and the Multilateral Investment Guarantee Agency (MIGA).

Shubham Chaudhuri, the Nigerian Country Director for World Bank, said “This country partnership framework will guide our engagement for the next five years in supporting the government of Nigeria’s strategic priorities by taking a phased and adaptive approach.”

“To realize its long-term potential, the country has to make tangible progress on key challenges and pursue some bold reforms. Our engagement will focus on supporting Nigeria’s efforts to reduce poverty and promote sustained private sector-led growth.”

The Bretton Wood institution, in a statement issued on Tuesday, said the loan is a five-year (2021 to 2024) country partnership framework.

The bank said the facility will focus on four areas of engagement namely investing in human capital, promoting jobs and economic transformation and diversification, enhancing resilience, and strengthening the foundations of the public sector.

Nigeria has now received a combined $4.9 billion from the two leading multilateral financial institutions since COVID-19 broke out in the country. The International Monetary Fund approved a $3.4 billion facility for Africa’s largest economy in May and the World Bank’s latest $1.5 billion.

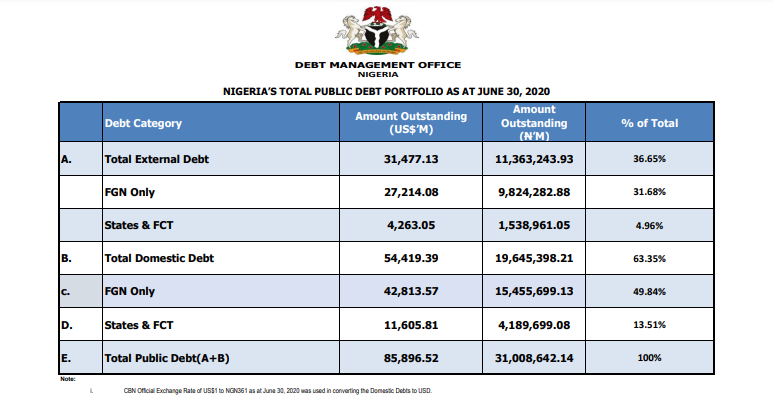

Nigeria’s total public debt rose to US$85.896 billion or N31.009 trillion on June 30, 2020, according to the Debt Management Office (DMO). External debt stood at US$31.477 billion or N11.363 trillion, representing 36.65 percent of the nation’s total debt.

Nigeria’s total debt is now expected to hit N32 trillion as previously projected by the Minister of Finance, Budget and National Planning, Mrs. Zainab Ahmed.