Finance

Zenith Bank Sets a New Record, Posts N508.979 Billion Gross Earnings in Nine months

Zenith Bank continues its impressive run in the first nine months of the year despite COVID-19 and other business challenges that limited businesses operating in Nigeria.

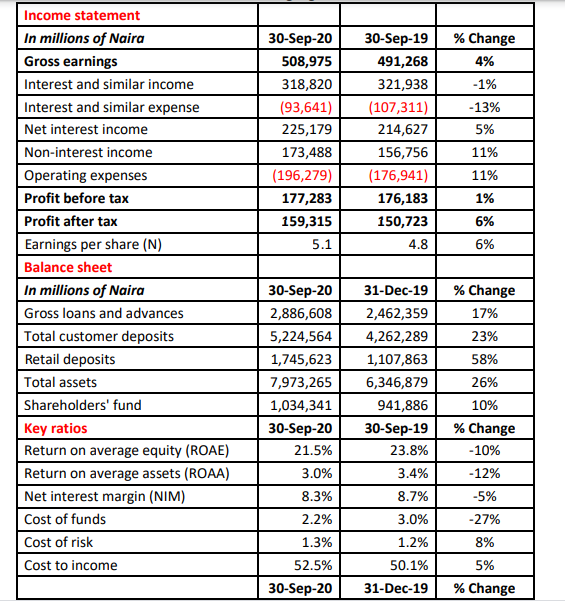

The leading financial institution reported N508.975 billion gross earnings in the nine months ended September 30, 2020. This was 4 percent higher than the N491.268 billion posted in the same period of 2019.

The bank disclosed in the unaudited financial statements released through the Nigerian Stock Exchange (NSE).

Zenith Bank grew interest and similar income declined by 1 percent to N318.820 billion in 2020, slightly down from N321.938 billion.

Net interest income rose by 5 percent from N214.627 billion filed in 2019 to N225.179 billion in 2020.

Operating expenses expanded by 11 percent to N196.279 billion during the period under review, up from N176.941 billion filed in 2019.

Profit before tax grew by 1 percent from N176.183 billion in 2019 to N177.283 billion in 2020, while profit after tax declined by 6 percent to N159.315 billion, down from N150.723 billion achieved in the corresponding period of 2019.

Key Financial Highlights

In the press release that accompanied the unaudited financial statements, Zenith Bank said “Total deposits closed at ₦5.2 trillion at the end of Q3 2020 up from ₦4.3 trillion in December 2019, dominated by low-cost deposits. Retail deposits continued to grow strongly to ₦1.7 trillion at the end of Q3 2020 up from ₦1.1 trillion as at December 2019, underpinned by the continuous expansion and improvement of the Group’s digital platforms.

In terms of asset quality, the NPL ratio improved to 4.80% (FYE 2019: 4.95%), despite growing loans and advances by 17 % from ₦2.5 trillion as at December 2019 to ₦2.9 trillion at the end of Q3 2020, affirming the Group’s prudent credit risk management.

Our liquidity and capital adequacy ratios (CAR), at 67.4% (Bank: 52.5%) and 21.5% respectively at the end of Q3 2020, remain above regulatory thresholds of 30.0% and 15.0% respectively. This gives headroom for providing support to businesses while creating risk assets opportunities in line with our credit risk management framework.

Going into the final quarter of the year, we will remain resilient as we keep adapting to the headwinds in the operating environment and continue to deliver enhanced customers experience and stakeholders value.