Markets

Oil Price Drops as OPEC+ Lowers Demand Projection

Oil Price Drops Following OPEC+ Meeting

Oil price extended its decline on Friday following OPEC+ meeting on Thursday.

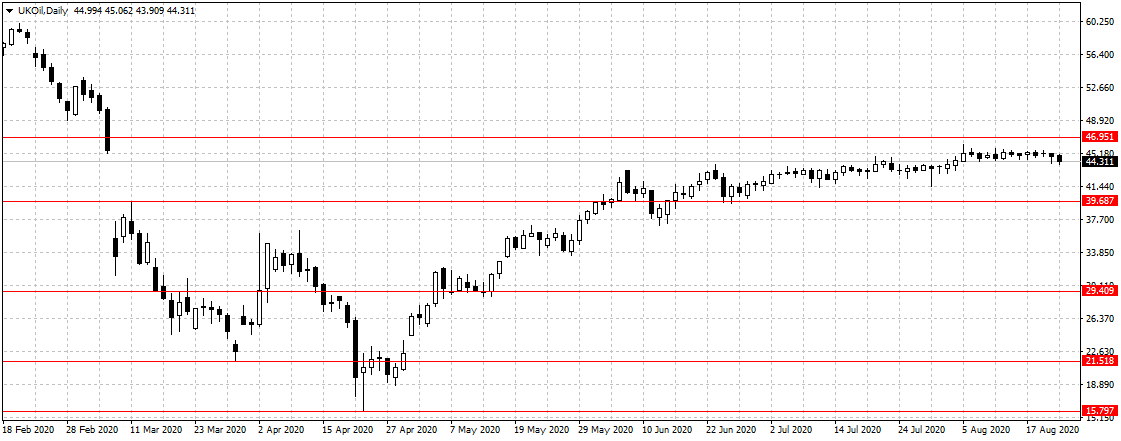

Brent crude oil, against which Nigerian oil is priced, declined from $45.16 per barrel it traded to $44.31 per barrel on Friday after OPEC and allies lowered oil demand for the year by 9.1 million barrels per day (mbpd).

The cartel expects oil demand to dip by as much as 11.2 million bpd if the second wave of coronavirus is not well contained in the second half of the year.

The uncertainty surrounding the COVID-19 pandemic and the global demand for the commodity weighed on the oil market on Thursday and Friday as energy traders and investors doubt the current price level can be sustained.

While Brent crude oil has remained above $40 per barrel for almost three months, a further decline in price would hurt Nigeria’s ability to fund its 2020 budget and at the same time continue to service its huge debt.

Also, with economic activities gradually opening up, especially with the expected resumption of international flights on August 29, demand for forex is likely to surge further and drag on the nation’s weak foreign reserves.

Also, with economic activities gradually opening up, especially with the expected resumption of international flights on August 29, demand for forex is likely to surge further and drag on the nation’s weak foreign reserves.

However, experts doubt the demand for crude oil would reach pre-pandemic levels in 2021, meaning they have concluded that 2020’s demand may not get better than this.

Rystad Energy, an energy consultancy firm, said in a note that “Demand, in our view, is only likely to near pre-pandemic levels in 2021 and the rest of 2020 will be a muted struggle while facing the effects of the second wave.

“On a positive note, compared to our expectations, OPEC+ has still complied as an alliance quite well with the target cuts, and that is why prices maintain their 40+ dollar levels. The cuts that this group of countries has implemented are unprecedented and have helped the market.

“While there is so much uncertainty over Covid-19, the current global production levels are providing a cushion for prices to safe-guard some profitability for producers.

“Now that the OPEC+ meeting is behind us, we believe we will enter a short-term period of bearish news, with a moderate global oil glut shaping in the next three months. Traders will be keeping an eye on global inventories in weeks to come as crude stock levels and refinery runs will be the key indicators of where the global market is moving.”