Markets

Crude Oil Expands Gain on US Stimulus talks, Better Than Expected Chinese Factory Data

Crude Oil Gains on US Stimulus, Better Than Expected Chinese Factory Data

Oil prices extended its gains on Tuesday following a better than expected factory data from China and a possible agreement between Democrats and Republicans on economic stimulus.

“The oil complex is heavily reliant on that aid. We need people to be able to boost economic activity to spur demand,” said John Kilduff, partner at Again Capital in New York.

President Trump on Monday said House Speaker, Nancy Pelosi and Senator Chuck Schumer, top Democrat in the chamber of Congress, wanted to meet him to discuss or make a deal on coronavirus-related economic stimulus.

The possibility of a stimulus deal, coupled with a reduction in China’s factory deflation in the month of July due to the surge in oil prices and improved industrial activity bolstered the outlook of the energy sector.

China is the world’s largest importer of crude oil. Therefore, improved factory activity generally boosts the oil market.

Also, the announcement from Iraq that it planned to cut an additional 400,000 barrels per day in August and September to compensate for its previous overproduction above OPEC+ quota aided the oil market this week.

“This would send out a strong signal to the oil market on various levels. That said, this would also require the international companies operating in Iraq to join in with the cuts,” Commerzbank analyst Eugen Weinberg said.

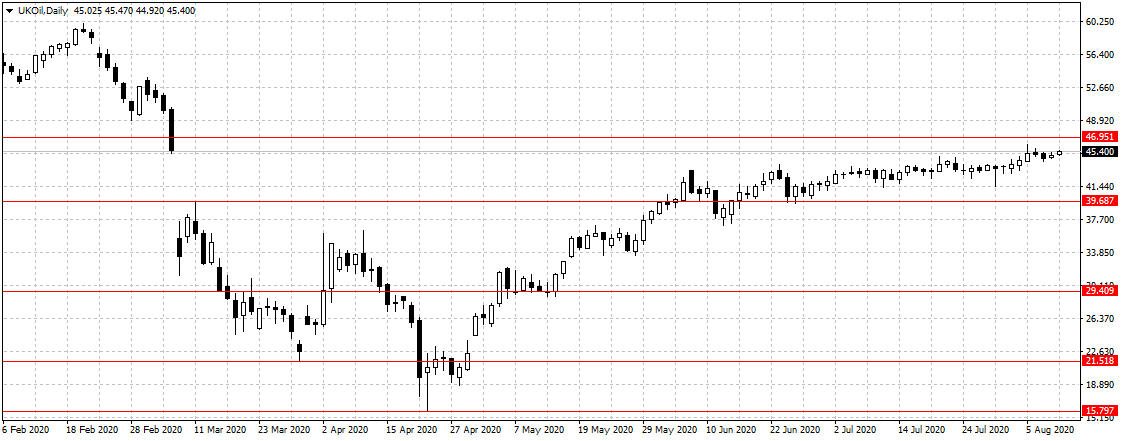

The Brent crude oil, against which Nigerian oil is priced, expanded from $41.30 per barrel it traded on Monday to $45.40 per barrel on Tuesday at 10:10 am Nigerian time.

While the U.S West Texas Intermediate crude oil rose from $41.48 per barrel to $42.47 per barrel on Tuesday.

While the U.S West Texas Intermediate crude oil rose from $41.48 per barrel to $42.47 per barrel on Tuesday.