Finance

Access Bank Refunds Debited ‘Stamp Duty Charge’ Amid Customers’ Outcry

Access Bank Refunds ‘Stamp Duty Charge’ Following Outcry

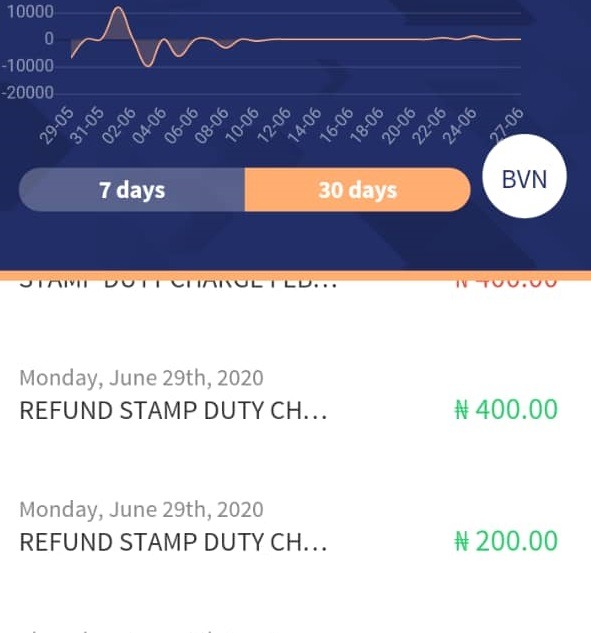

Access Bank Plc on Sunday refunded the already debited Stamp Duty Charge following customers’ outcry.

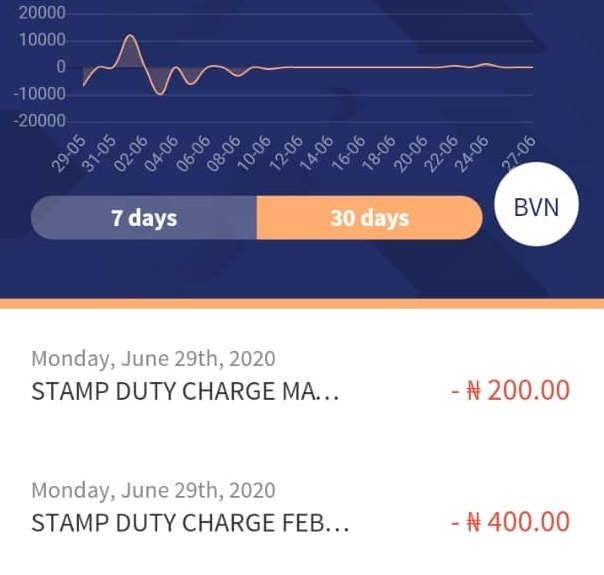

Earlier this week, the bank had informed all customers that all stamp duty not charged from February to April 2020 will now be charged in line with the Federal Government mandate.

In a statement released on Sunday, the lender said ‘Stamp Duty Charge’ collection is a mandate stipulated in the Finance Act, 2019 (Stamp Duty Act, Cap S8) and like every other bank, Access Bank is required to charge as applicable and remit all debited funds to the Federal Government.

However, because of the ongoing economic situation, negative impacts of COVID-19 pandemic on customers and customers’ feedback that the decision is unwelcome at this tough period, the lender refunded all debited Stamp Duty charges on Sunday, according to customers.

The bank said “we have heard our customers’ feedback that this charge is unwelcome, especially at this time against a challenging economic backdrop. We have considered your feedback and have decided to pay the Stamp Duty on our customers’ behalf for the affected period only. This means all individual and SMEs who were debited for the accumulated Stamp Duty charge for February to April 2020, will be refunded.

“While we still have to remit these funds via the CBN to the Federal Government, we realise that we got it wrong by debiting our customers late and we are refunding the affected stamp duty charge today to all affected customers.”

Below is the bank’s complete statement.