Cryptocurrency

Bitcoin Rebounds from Almost a Month Low to $9464 on Tuesday

Bitcoin Emerges from Almost A Month Low During Asian Trading Session

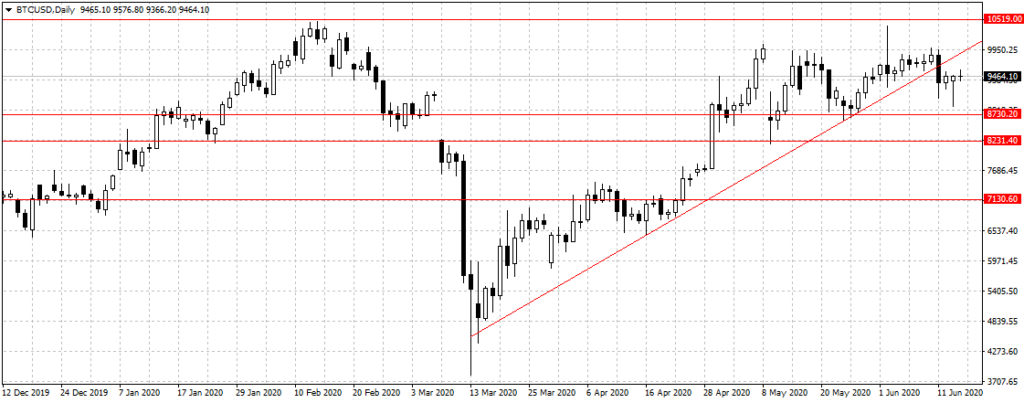

Bitcoin rebounded on Tuesday from almost a month record low of $8888 to $9464 a coin during the Asian trading session.

Cryptocurrency’s most dominant coin had plunged with about $10 billion drops in cryptocurrency market capitalisation on Sunday, according to the available data on CoinMarketCap.

This was because cryptocurrency institutional investors were perturbed by the Federal Reserves’ comment that the US economy might take a few years to recover from the current pandemic downturn.

However, unlike the stocks and other traditional assets, Bitcoin recovered about 50 percent of its losses within two days. Also, this is another sign that the cryptocurrency ‘is to some extend’ correlated with traditional assets and their underlying fundamentals.

Global uncertainty continues to weigh on the entire global assets, including Bitcoin and other cryptocurrencies as outside capital inflow from institutional investors remains weak.

Edward Morra, a cryptocurrency analyst on Twitter, said “BTC Volatility nearing the 3M lows. We are back to 7th of March pre-crash levels. Expecting “big moves” this upcoming week. Probably worth setting a straddle option set.”

Again, the digital coin remains within the bearish zone and above the $8730 key support level established in May.

At Investors King, we will expect a break below that support level to open up $8231.30 and eventually $7130.60 support level.

At Investors King, we will expect a break below that support level to open up $8231.30 and eventually $7130.60 support level.

We will need a sustained break of $10,519 resistance level to validate bullish continuation as explained last week.

Meanwhile, JPMorgan has described Bitcoin as a resilient asset for surviving the March economic downturn. This is coming after Goldman Sachs, one of the world’s largest investment banks, rubbished Bitcoin and other cryptocurrency.

Goldman told clients in May that Bitcoin and other cryptocurrencies are not investment vehicles and should not be regarded as such.