Economy

Oil Prices Decline Following Saudi Comments on Voluntary Cuts

Oil Prices Dropped After Saudi Arabia Said it Won’t Cut Additional 1.8mbpd in July

Oil prices dipped on Tuesday following seven consecutive days of bullish runs.

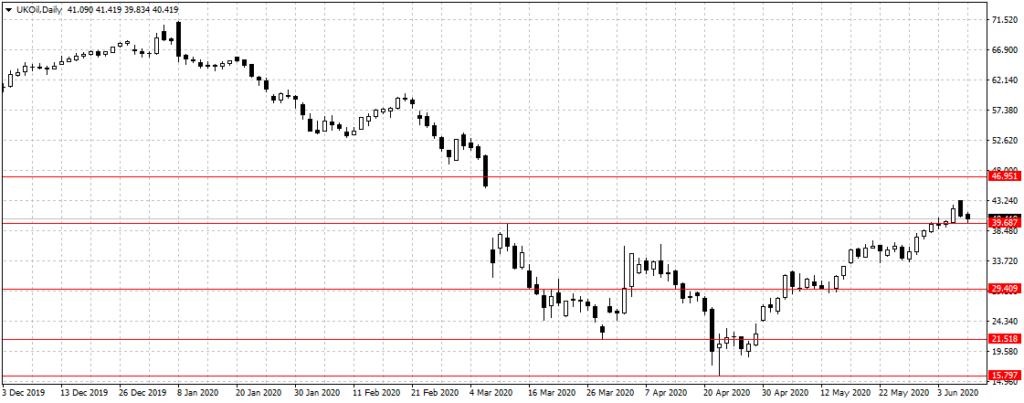

Brent crude oil, against which Nigerian oil price is measured, declined from $43.28 per barrel it traded on Monday, a three-month high, to $40.36 on Tuesday as at 1:33 pm Nigerian time.

While the US West Texas Intermediate (WTI) dipped from $40.41 per barrel it traded on Monday to $37.71 on Tuesday.

While the US West Texas Intermediate (WTI) dipped from $40.41 per barrel it traded on Monday to $37.71 on Tuesday.

Oil prices rose after the Organisation of the Petroleum Exporting Countries (OPEC) and allies, known as OPEC+, agreed to extend 9.7 million barrels per day production cuts accord reached in late April to July ending.

The positive outcome bolstered the oil market substantially, however, experts said the market needs more cuts to sustain price at above $40 per barrel or even push for $50 given the global supply level.

“If you take February to May, you’ve got an average built position, oversupply of 14 million barrels a day. So we’ve effectively built about 2 billion barrels of additional storage,” Payne told CNBC’s “Street Signs” on Monday.

“We definitely need to drain that before we can see prices move materially above that kind of ($40 to $50) price structure,” Payne said.

Saudi Arabia Energy Minister, Prince Abdulaziz bin Salman, in comments quoted by CNBC, said the country won’t be cutting additional barrels of 1.8 million per day in July. This was after experts said the top oil producer and other OPEC members may cut an additional 1.8 million bpd in July to take the total expected production cuts for the month to about 11 million barrels per day.

“It would be too good to be true to have a total of nearly 11 million bpd in voluntary cuts extended for a month at times when we see supply deficits,” said Bjornar Tonhaugen at Rystad Energy.

Meanwhile, Saudi Arabia and other top oil producers have increased oil prices for the month of July to the Asian region.