Economy

Oil Prices Shed 4% Amid Rising US-China-Hong Kong Tension

- Oil Prices Shed 4% Amid Rising US-China-Hong Kong Tension

Oil prices dipped on Wednesday as tension brew between the two world’s largest economies over Hong Kong.

The Republic of China had concluded plans to impose new national security law on Hong Kong to prevent “splittism, subversion, terrorism, any behaviour that gravely threatens national security and foreign interference” in the semi-autonomous nation.

A decision many Hong Kong citizens frown against and immediately took to the street to protest. The US secretary of state, Mike Pompeo, immediately warned that the US will start treating Hong Kong as China if the nation’s lawmakers go-ahead to enact such law.

“No reasonable person can assert today that Hong Kong maintains a high degree of autonomy from China, given facts on the ground,” Mr Pompeo said on Wednesday.

Pompeo further stated that Hong Kong is ‘no long autonomous’ from China. A declaration many people believed could mean the city will no longer enjoy special treatments from the world’s largest economy and may force the US to impose similar trade sanctions to China on the world’s financial hub.

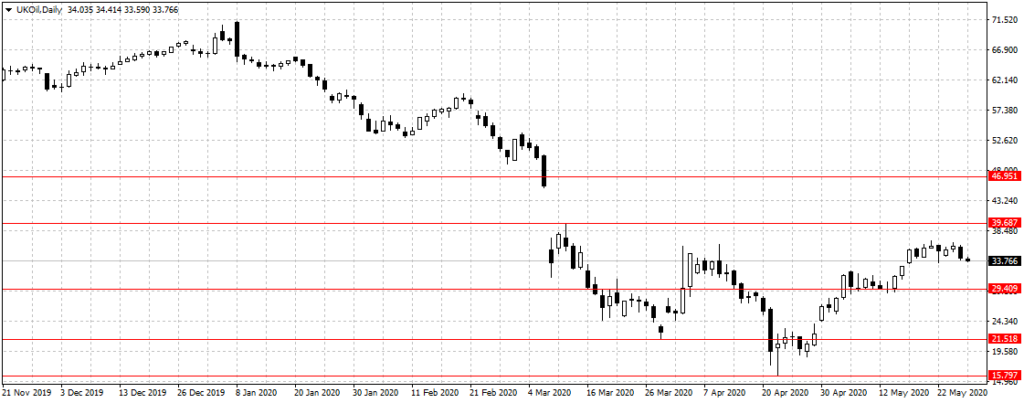

The Brent crude oil, against which Nigerian oil price is measured, declined by 4 percent to $33.76 per barrel on Thursday during the Asian trading session.

While the US West Texas Intermediate crude oil sheds 5 percent to trade at $32 per barrel.

While the US West Texas Intermediate crude oil sheds 5 percent to trade at $32 per barrel.

“Traders are concerned that expected recovery in [energy] demand may be delayed if U.S.—China—Hong Kong political tension grows, and hence is weighing in on prices,” Manish Raj, chief financial officer at Velandera Energy, told MarketWatch. “This timing impact is seen in [the] futures curve, whereby near months have declined while outer month contracts are holding steady.”

Also, the uncertainty surrounding OPEC plus production cuts continue to impact oil outlook as traders doubted Russia commitment to the 9.7 million barrels per day production cuts agreement reached in April.

“The July target is in line with the current OPEC+ deal, which has a record-breaking combined production cut of 9.7 [million barrels per day] among participants,” said Robbie Fraser, senior commodity analyst at Schneider Electric.

“However, some in the group are likely to voice support for extending cuts beyond July—particularly if the market remains clearly oversupplied amid lackluster summer driving demand,” he said in a daily note.

“Russia’s comments would suggest such an extension is unlikely for now, but ultimately even the group’s most skeptical members may change their stance depending on price evolution and market fundamentals,” said Fraser. “OPEC’s formal meeting next month will be key in determining the tentative path forward.” OPEC and its allies plan to meet on June 10 via videoconference.