Cryptocurrency

Goldman Sachs Rubbishes Bitcoin, Says its Not Real Asset

- Goldman Sachs Rubbishes Bitcoin, Says its Not Real Asset

Goldman Sachs, one of the world’s leading investment banks, has once again rubbished Bitcoin in a leaked report to clients.

The investment bank maintained its position that Bitcoin and other cryptocurrencies are not viable investment vehicles under the present economic environment

Goldman Sachs said, “Cryptocurrencies including bitcoin are not appropriate as an asset class.”

It explained that the volatile price movements of the cryptocurrencies remain unstable and does not correlate with other asset classes and lack clear evidence that it can serve as an inflation hedge as claimed by Bitcoin ardent fans.

“We believe that a security whose appreciation is primarily dependent on whether someone else is willing to pay a higher price for it is not a suitable investment for our clients,” Goldman stated.

Sharmin Mossavar-Rahmani, the chief investment officer for wealth management at the bank, said “We also believe that while hedge funds may find trading cryptocurrencies appealing because of their high volatility, that allure does not constitute a viable investment rationale.”

However, cryptocurrency enthusiasts immediately took to Twitter to attack Goldman Sachs leaked report.

These include Tyler and Cameron Winklevoss, the twins that dragged Mark Zuckerberg to court before becoming Bitcoin billionaires.

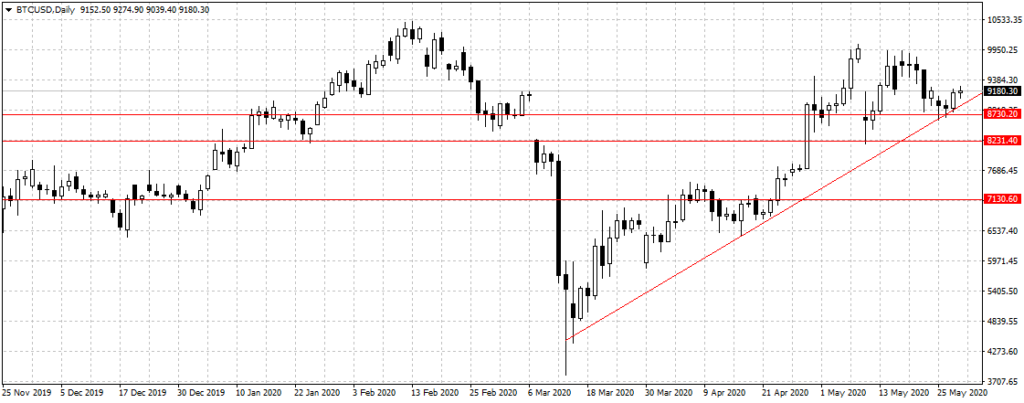

Meanwhile, Bitcoin remained above the $8,730 support levels after reports of certain Whales acquiring a combined 12,000 BTC became public. The dominant cryptocurrency rose to $9,180 per coin as at 4:16 am Nigerian time on Thursday.