Finance

Naira Exchanges at N570 to a Dollar As Demand Outweighs Supply

- Naira Exchanges at N570 to a Dollar As Demand Outweighs Supply

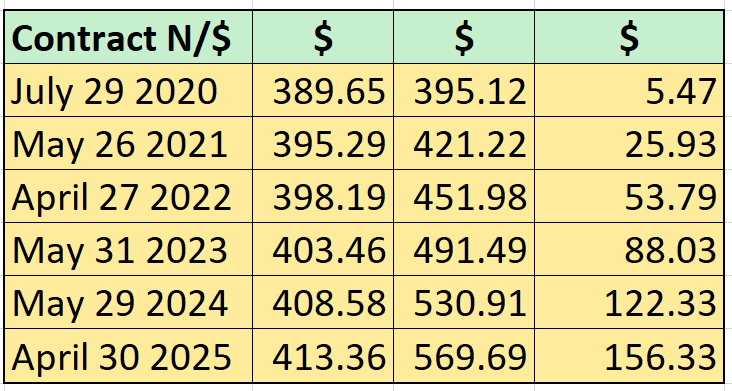

The Nigerian Naira posted its biggest decline on Thursday as price differential on five-year naira futures expanded by N156 or 27 percent from N413.36 to close at N569.69 in the Fx Non-Deliverable Forward market.

According to traders interviewed by Reuters, while the Central Bank of Nigeria (CBN) had weakened the local currency by N73 on average across tenors, the five-year Naira futures weakened to 569.69 as investors doubted the apex bank’s ability to support the currency given weak foreign reserves and low oil prices.

The Central Bank of Nigeria had devalued the Nigerian Naira following plunged in oil demand, oil prices and foreign reserves due to COVID-19 pandemic. The currency was technically devalued to slow down surged in capital flight that trailed global lockdown amid an increase in global risk, especially in emerging markets usually associated with weak fiscal buffers.

The three months Non-Deliverable Naira contract expected to expire on July 29, 2020 declined by N5.47 from N389.65 to N395.12 as shown below. The depreciation is as a result of weak dollar liquidity and the increase in demand for the US dollar by foreign investors looking to move their funds out of the country.

The depreciation is as a result of weak dollar liquidity and the increase in demand for the US dollar by foreign investors looking to move their funds out of the country.

Investors King reported earlier today that foreign investors pulled out N186.6 billion in the first quarter of the year, up from N124.24 billion in the first quarter of 2019.

The uncertainty surrounding Nigeria’s economic outlook given the nation’s weak fiscal buffer, rising debt profile, weak foreign reserves and high unemployment of 23.1 percent remains investors’ concern post-pandemic.

With the local currency trading at N570 to a US dollar, it is likely the central bank will devalue the Naira once again to ease pressure on the foreign reserves.