Technology

Okra Raises $1m to Connect Bank Accounts to Apps

- Okra Raises $1m to Connect Bank Accounts to Apps

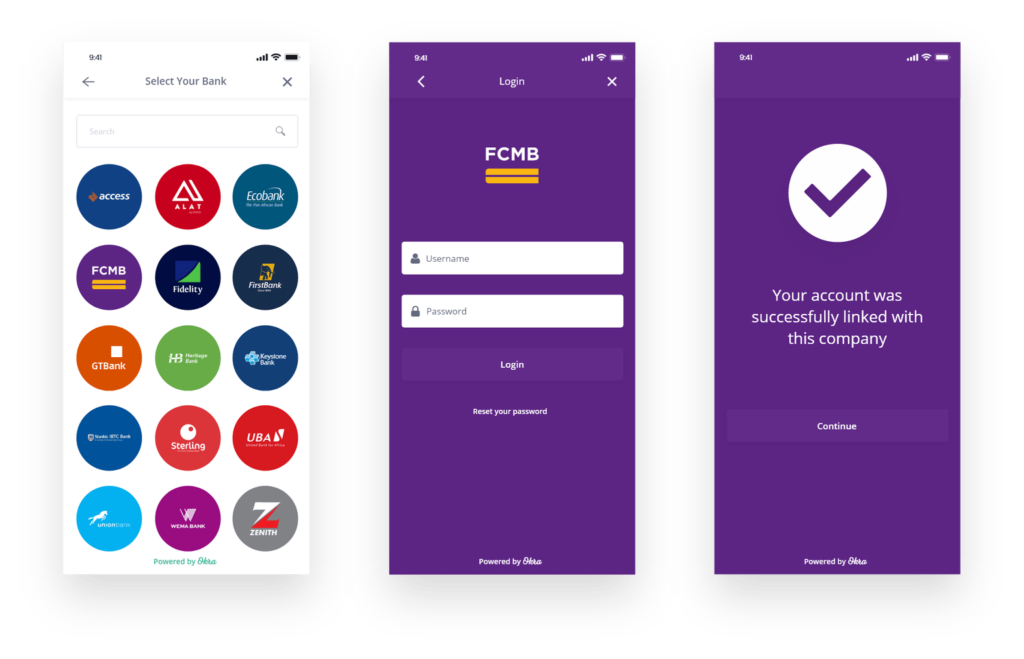

Nigerian new startup, Okra, has raised $1 million in pre-seed funding from TLcom Capital to connect bank accounts to Apps.

The financial technology startup founded by Fara Ashiru Jituboh and David Peterside in June 2019 will focus on connecting accounts and financial data to banking apps.

According to Ashiru Jituboh, “We’re building a super-connector API that…allows individuals to connect their bank accounts directly to third party applications. And that’s their African bank accounts starting in the largest market in Africa, Nigeria.”

According to Ashiru Jituboh, “We’re building a super-connector API that…allows individuals to connect their bank accounts directly to third party applications. And that’s their African bank accounts starting in the largest market in Africa, Nigeria.”

Okra is focusing on Africa’s largest market at the moment, according to Ashiru Jituboh. The Africa’s most populous nation serves as a major financial hub on the continent. However, there’s still a disconnect between fintech apps and banks.

She said: “There are approximately 125mn banks accounts in Nigeria alone – but over the course of the next two years, we will see that figure rise exponentially, which presents huge opportunities for growth. Our role within this is to deliver ease, speed, and transparency to key players within the fintech space so they can get back to driving our continent forward.”

“Simple financial tasks like budgeting, internal reconciliations, and credit assessments have been additional stressors for businesses and we’re filling a long-standing gap in the market,” Co-Founder and COO, David Peterside explains, adding that the aim is to make the processes seamless for clients so they can focus on their core services.

“Our thesis is simple – financial innovation cannot exist without the proper infrastructure, which is data,” Co-Founder and CEO Fara Ashiru Jituboh said. “Essentially, how far the African fintech sector can grow is intrinsically tied to the success of infrastructure like Okra and with our core market in Nigeria, we’re opening the door to another level of innovation in Africa’s largest market.”