Economy

Oil Trading at -$37.45 for the First Time

- Oil Trading at -$37.45 for the First Time

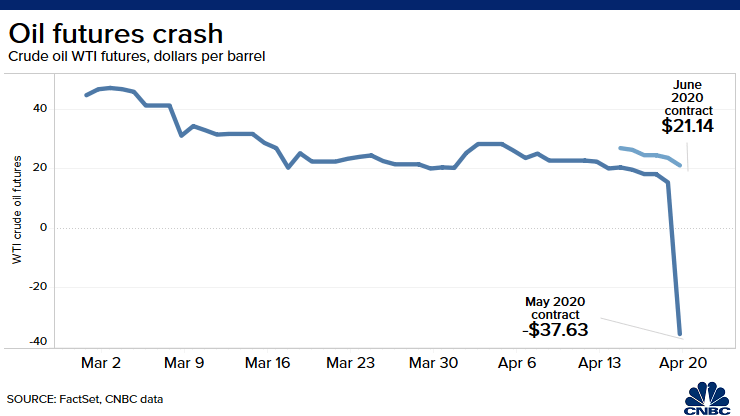

Oil price plunged below zero in the futures market as traders exit their contract to avoid taking delivery of physical crude due to rising global oil glut and risk.

The West Texas Intermediate crude oil for May delivery dipped as low as -$37.45.98 a barrel, a decline of over 300 percent. The lowest the commodity ever traded, according to data from the Federal Reserve Bank of St. Louis.

This simply means sellers will have to pay buyers $37.45 per barrel to help them clear crude stockpiles amid falling oil demand. “There is little to prevent the physical market from the further acute downside path over the near term,” said Michael Tran, managing director of global energy strategy at RBC Capital Markets. “Refiners are rejecting barrels at a historic pace and with U.S. storage levels sprinting to the brim, market forces will inflict further pain until either we hit rock bottom, or COVID clears, whichever comes first, but it looks like the former.”

“There is little to prevent the physical market from the further acute downside path over the near term,” said Michael Tran, managing director of global energy strategy at RBC Capital Markets. “Refiners are rejecting barrels at a historic pace and with U.S. storage levels sprinting to the brim, market forces will inflict further pain until either we hit rock bottom, or COVID clears, whichever comes first, but it looks like the former.”

Oil started declining after OPEC+ failed to reach an agreement despite the global pandemic that broke out in Wuhan, China. Global lockdown caused by the COVID-19 pandemic, however, erased over 30 million barrels per day in global oil demand to worsen the oil market as traders exit their positions to avoid further losses.

“Basically, bears are out for blood,” said Naeem Aslam, the chief market analyst at AvaTrade. “The steep fall in the price is because of the lack of sufficient demand and lack of storage place given the fact that the production cut has failed to address the supply glut.”

He added: “The bottom line is that there is no doubt that oil prices are way oversold at the current level, but given the circumstances, it is likely that the price may continue to fall further because the rig count hasn’t touched its bottom yet.”