Economy

Inflation Rate Rises by 12.2% in February

- Inflation Rate Rises by 12.2% in February

Prices of goods and services continue to surge in Africa’s largest economy Nigeria in the month of February, according to the National Bureau of Statistics (NBS).

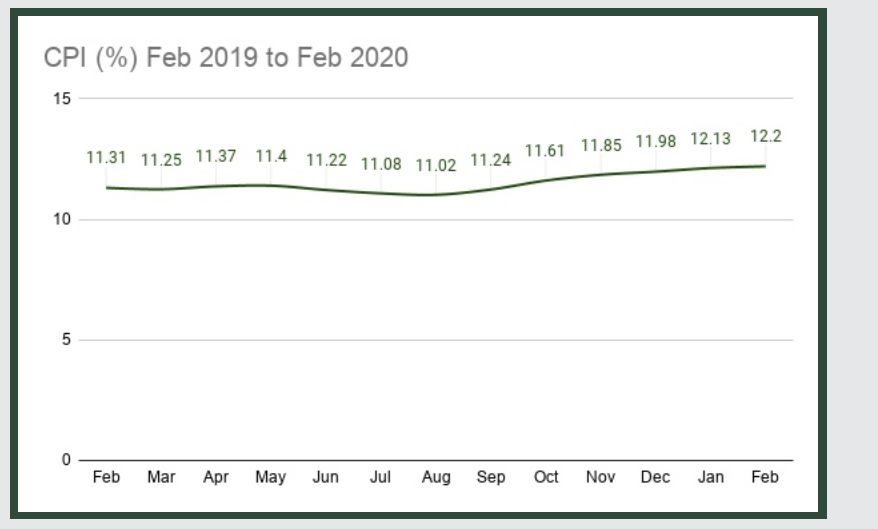

The Consumer Price Index, which measures the inflation rate, increased by 12.20 percent year-on-year in the month under review, up by 0.07 percent from 12.13 percent recorded in January.

Prices have been on the rise since President Muhammadu Buhari ordered the closure of the nation’s land borders to protect local production and stimulate the consumption of local produce. However, the decision has led to the continuous increase in the price of goods as Africa’s largest economy remains behind on production of several key items.

Prices have been on the rise since President Muhammadu Buhari ordered the closure of the nation’s land borders to protect local production and stimulate the consumption of local produce. However, the decision has led to the continuous increase in the price of goods as Africa’s largest economy remains behind on production of several key items.

This coupled with falling foreign reserves could escalate prices, especially with dollar revenue generation declining with low oil prices and decreasing demand for crude oil in the international market due to coronavirus outbreak.

On a monthly basis, the index grew by 0.79 percent in February, down by 0.08 percent from the 0.87 percent filed in January.

The composite food index grew by 14.90 percent in the month from 14.85 percent filed in the month of January.

NBS attributed the increase in prices to the surge in prices of Bread and Cereals, Fish, Meat, Vegetables and Oils and Fats.

While the average annual rate of the Food sub-index for the twelve months ended February stood at 13.98 percent, slightly higher than the 13.86 percent recorded in January. Suggesting that prices of food items remain high despite measures to contain it.

Still, with the Central Bank of Nigeria’s ability to intervene at the foreign exchange market to prop up the Naira value diminishing, prices are likely to surge even more. Naira exchange rate to U.S dollar already trading at N400 per dollar at some parallel markets in Lagos as speculators seems to be convinced that the apex bank would have to devalue the local currency at some point.

This increase in the exchange rate would be passed on to final consumers given that Nigeria is an import-dependent economy with limited local productions.

Meanwhile, the Central Bank of Nigeria on Monday announced measures to sustain economic activities at a period of high uncertainty. The apex bank lowered the interest rates on intervention facilities from 9 percent to 5 percent to support businesses and sustain job creation. However, this does not address dollar liquidity in the near-term.