Finance

South African Rand Plunges on Monday as Investors Abandon Assets

- South African Rand Plunges on Monday as Investors Abandon Assets

Rand, the local currency of Africa’s second-largest economy South Africa, plunged by 8 percent following surged in global uncertainty amid OPEC failure to secure Russia supports for an additional 1.5 million barrels per day cut.

The local currency plunged to its lowest level on a closing basis since January 1980 as investors across the global abandoned riskier assets for safe havens.

South African economy plunged into recession in the final quarter of 2019 following a broad-based decline in growth across key sectors. Making it the nation’s second recession in two years.

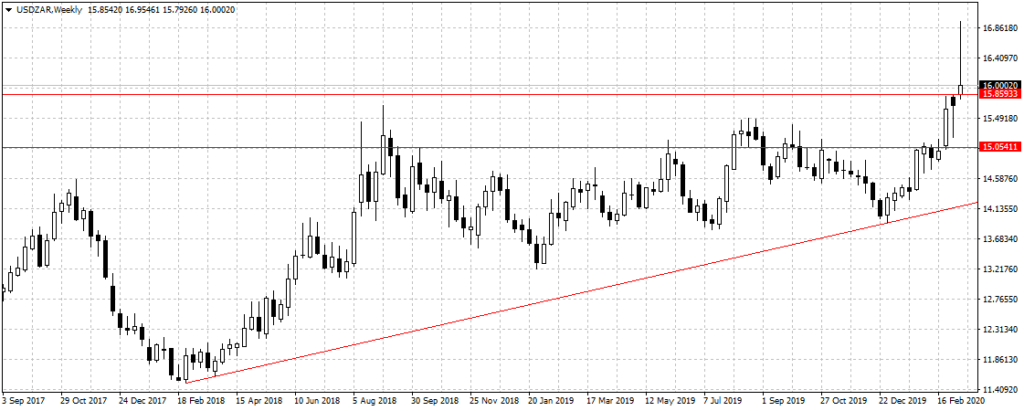

The local currency declined from 16.954 against the U.S dollar on Monday during the Asian trading session to 15.850. This was after global oil prices crashed by 30 percent after OPEC plus production cut deal failed with Russia announcing it would end production cuts discussion with the current agreement due to expire this month.

Global investors abandoned riskier assets for safe haven, bolstering the attractiveness of the Japanese Yen to 101.84 against the US dollar on Monday, moving more than 675 pips in the last two weeks as shown below.

Global investors abandoned riskier assets for safe haven, bolstering the attractiveness of the Japanese Yen to 101.84 against the US dollar on Monday, moving more than 675 pips in the last two weeks as shown below.

South African Randy jumped up to 16.954 against the US dollar after President Cyril Ramaphosa announced the appointment of Nigerian former Minister Okonjo Iweala as a member of South Africa’s Economic Advisory Council alongside other international gurus. However, that was not enough to discourage investors from abandoning the assets of the embattled African nation for haven assets.

South African Randy jumped up to 16.954 against the US dollar after President Cyril Ramaphosa announced the appointment of Nigerian former Minister Okonjo Iweala as a member of South Africa’s Economic Advisory Council alongside other international gurus. However, that was not enough to discourage investors from abandoning the assets of the embattled African nation for haven assets.