Cryptocurrency

Bitcoin Plunges With Other Assets to $7937

- Bitcoin Plunges With Other Assets to $7937

The world’s most dominant cryptocurrency on Monday plunged with other global assets to this year’s low.

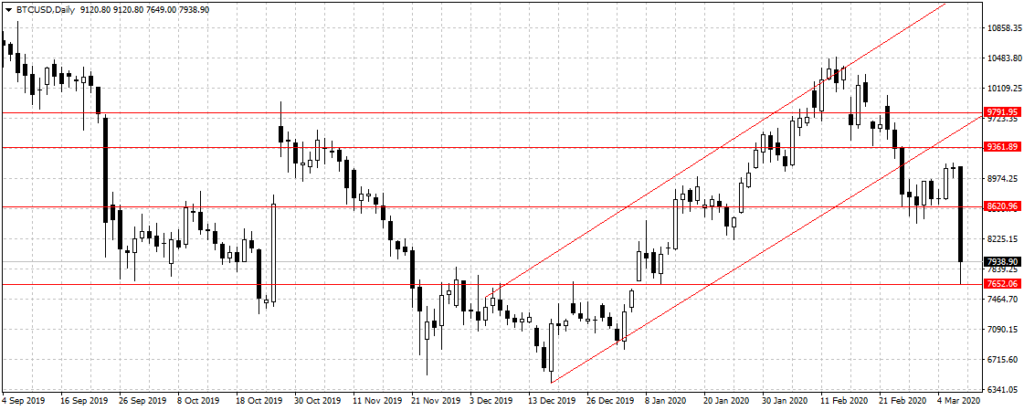

The virtual current nosedived from $9120 per coin it opens on Monday morning during Asian trading session before declining more than 9 percent to $7649, its 2020 record low, before pulling back to $7938 per coin.

The highly volatile digital currency has been trading in a range for the past seven days before dropping below $8620 support level on Monday after OPEC failed to secure Russia supports to cut crude oil production by an additional 1.5 million barrels per day.

The highly volatile digital currency has been trading in a range for the past seven days before dropping below $8620 support level on Monday after OPEC failed to secure Russia supports to cut crude oil production by an additional 1.5 million barrels per day.

The uncertainty surrounding global commodity, especially with fast-spreading coronavirus, has started impacting the digital currency that is gradually acting like an asset of value but not haven asset as previously projected by most analysts.

Despite, an expert on Cointelegraph, saying the current plunge below the $8000 support level has nothing to do with coronavirus and the present global uncertainty but a huge sell-off on the PlusToken pyramid scheme, that notion is uncertain due to unavailability of data to back that declaration rather than a twitter account called Ergo.

Ergo, the Twitter account that monitors the pyramid scheme, had claimed 13,000 BTC valued at $210 million were sold off in the early hours of Monday. Ergo agreed that the coins, the scheme managers, have started hiding their transactions, making it hard for analysts to project or analyse the impact of the scheme activities on the entire Bitcoin market given its low volume.

“Been looking and theorizing about this for months and I can’t see a scenario where the coins aren’t being sold, at least to some degree,” the account summarized.