Technology

Kuda Raises $1.6m to Kick Off Online Bank in Nigeria

- Kuda Raises $1.6m to Kick Off Online Bank in Nigeria

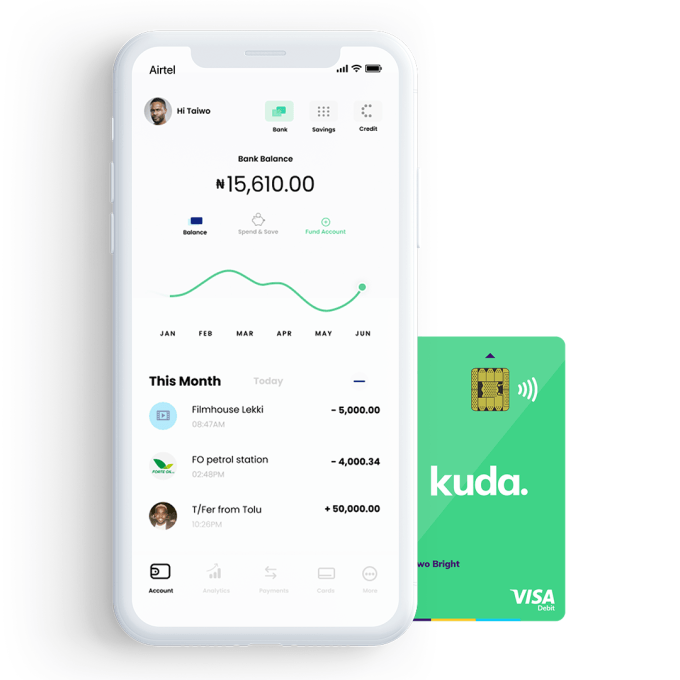

A Nigerian digital retail bank, Kuda, just raised $1.6 million in pre-seed funding to kick-off operations in the fourth quarter of the year.

The Lagos and London-based fintech startup launched its beta version shortly after securing its banking license from the Central Bank of Nigeria, a unique position compared to other fintech startups in Nigeria.

According to the founder of the company, Babs Ogundeyi, “Kuda is the first digital-only bank in Nigeria with a standalone license. We’re not a mobile wallet or simply a mobile app piggybacking on an existing bank.”

“We have built our own full-stack banking software from scratch. We can also take deposits and connect directly to the switch,” Ogundeyi stated, referring to Switch — a SWIFT-like system that facilitates bank communication and settlements in Nigeria.

The digital bank plans to offer checking accounts without monthly fees, a free debit card, offer consumer savings and P2P payments options when it kickoff operations.

“You can open a bank account within five minutes, do all the KYC in the app, and you get issued a new bank account number,” said Ogundeyi.

Ogundeyi, who has worked as a financial advisor to the Nigerian government, left a classified publication, Motortrader, to start Kuda in 2018 with former Stanbic Bank software developer, Musty Mustapha.

Ogundeyi, who has worked as a financial advisor to the Nigerian government, left a classified publication, Motortrader, to start Kuda in 2018 with former Stanbic Bank software developer, Musty Mustapha.

The two founders convinced Haresh Aswani to lead $1.6 million pre-seed funding with Ragnar Meitern and other angel investors. Aswani has since confirmed his investment and he is expected to take a position on the company’s board.

Kuda has now partnered three of Nigeria’s leading banks –GTBank, Access Bank and Zenith Bank — to deepen access and reach almost immediately.

This will allow Kuda customers to use partner banks’ branches and ATMs to deposit and withdraw funds without an additional fee.

“Even though we don’t own a single branch, we actually have the largest branch network in the country,” Ogundeyi claimed.