Economy

Oil Prices Fall Despite Saudi Assurance

- Oil Prices Fall Despite Saudi Assurance

Global oil prices fell on Thursday despite Saudi Arabia assurance on production cuts and a report that OPEC production slips to a 4-year low in April.

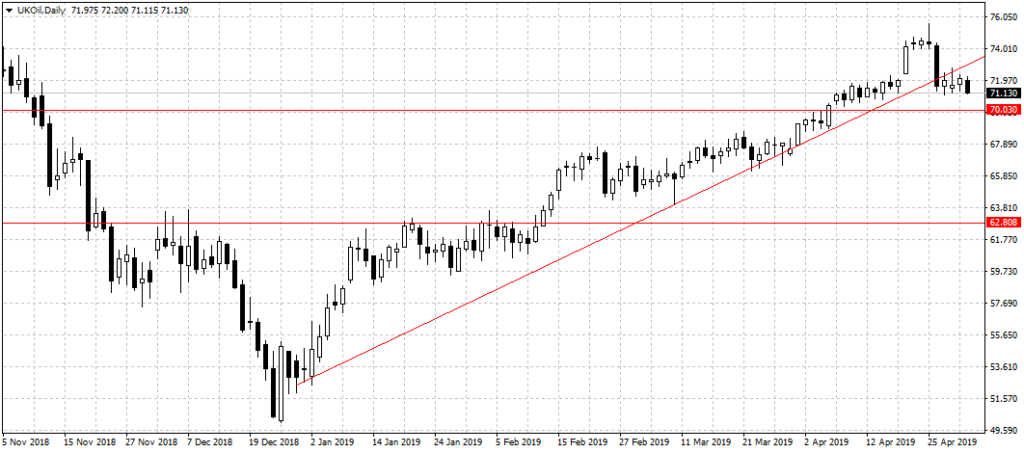

Brent crude oil, against which Nigerian crude oil is measured, declined from $72.34 a barrel it closes on Wednesday to $71.13 on Thursday.

While the U.S West Texas Intermediate declined from $63.90 per barrel to $62.70.

While the U.S West Texas Intermediate declined from $63.90 per barrel to $62.70.

A report released by the Energy Information Administration (IEA) on Wednesday showed U.S crude stockpiles rose to their highest since September 2017 to set a record of 12.3 million barrels per day for the week.

“Crude oil prices fell sharply as stockpiles in the U.S. rose to their highest level since 2017,” ANZ bank said on Thursday.

“This comes as U.S. refineries head into the spring maintenance period, stoking fears that crude oil demand will be soft and stockpiles will continue to rise,” it added.

The surge in inventories weighed on oil prices despite reports of a further drop in OPEC production level in April, Venezuela sanctions and the refusal of the Trump administration to renew waivers of eight countries importing from Iran.

On Wednesday, Mohammed bin Hamad al-Rumhy, Oman’s energy minister, said it was OPEC+’s plan to extend production cuts started in January 2019.

However, experts believe the plan to sustain high oil prices through production cuts maybe abandoned once President Trump increased pressure on Saudi Arabia to up production in order to force lower gasoline price ahead of the presidential campaign.

“The Venezuelan situation will likely loom large in OPEC deliberations as ministers weigh how many additional barrels may be needed to fill an expanding supply gap that is being driven by geopolitics as opposed to geology,” Canadian bank RBC Capital Markets said.