Economy

FMBN Disbursed N58bn Housing Loans in Two Years

- FMBN Disbursed N58bn Housing Loans in Two Years

Between April 2017 and March 2019, the sum of N58bn was disbursed by the Federal Mortgage Bank of Nigeria as housing loans to 23,600 beneficiaries.

The Group Head, Corporate Communications, FMBN, Mrs Zubaida Umar, confirmed this in a statement issued on Sunday.

The statement said the loan disbursement was in line with its determination to improve service delivery and extend access to its affordable housing solutions by more Nigerian workers.

The statement said the amount covered the National Housing Fund Mortgage loans to 3,171 Nigerian workers valued at N22.3bn, Home Renovation loans valued at N16.9bn to 20,429 Nigerian workers and Estate Development loans valued at N13.6bn.

It also said that the bank provided N2.7bn as Cooperative Development loans while the sum of N2.5bn was disbursed under the Ministerial Pilot Housing Scheme Project.

It said the loan disbursement of N58bn represented a significant increase in performance when compared to the N152bn, which the bank had given out over a 24-year period covering 1992 to April 2017.

It read in part, “Additionally, the FMBN also posted a strong performance in the processing of applications for refund of contributions to the National Housing Fund by workers who have retired from service.

“The company successfully processed 120,759 NHF refund cases and paid out a total of N16.5bn between April 2017 and March 2019.

“The amount, which the new management has recorded in terms of NHF refunds in about 24 months, exceeds the total of N10.8bn recorded between 1992 and April 2017, when the current management took office.

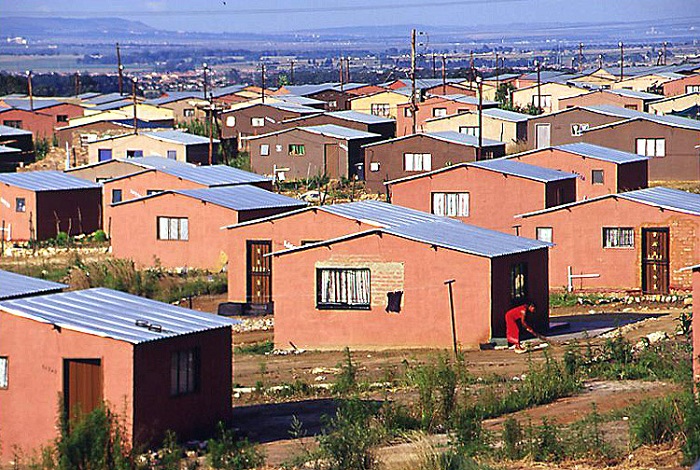

“Furthermore, the FMBN within the period under review funded the construction of 6,538 housing units across the country.”

Speaking on the development, the Managing Director, FMBN, Ahmed Dangiwa, stated that the results reflected the passion of the management to reposition the bank on the path of greater impact, responsiveness, and professionalism.

The statement quoted him to have said, “I am indeed very pleased with the remarkable results that we have been able to achieve in about two years since we were appointed to run the affairs of the bank.

“They demonstrate our determination to justify the confidence of President Muhammadu Buhari in our capacity to reform the FMBN as an effective tool in the hands of government to tackle the lingering housing deficit.”