Forex

Fed Hikes Rate for the Fourth Time in 2018

- Fed Hikes Rate for the Fourth Time in 2018

The Federal Reserve on Wednesday raised interest rates for the fourth time in 2018, despite pressure from President Donald Trump to maintain low borrowing costs to support productivity and safe falling equity market.

The Federal Reserves raised interest by 25 basis points from 2.25 percent to 2.5 percent, saying economic growth remained strong and positive.

“Economic activity has been rising at a strong rate, ” Chairman Jerome Powell said in a statement on Wednesday following a two-day meeting in Washington. The Chairman went on to say risks to the economy “are roughly balanced.”

Still, the Central Bank emphasized the possible impact of slowing global economy going into 2019.

The Federal Open Market Committee (FOMC) “will continue to monitor global economic and financial developments and assess their implications for the economic outlook,” the statement read.

The committee made an adjustment to its previous statement that “further gradual increases would be required” to “judges that some further gradual increases” in rates will likely be needed. Emphasizing the uncertainty of the situation due to other factors like global economics.

Despite Fed’s hawkish statement, investors remained pessimistic ahead of 2019, most are predicting one increase at most in 2019. Some believe the slowing economy in Europea, China, and Brexit weighing on United Kingdom growth will subdue growth in the new year and equally impact the U.S exports.

With the investors unclear on Fed’s position going into the new year, funds will be expected to move into the Euro area where the European Central Bank has announced it would stop bond-buying program in January 2019 and likely start raising rates.

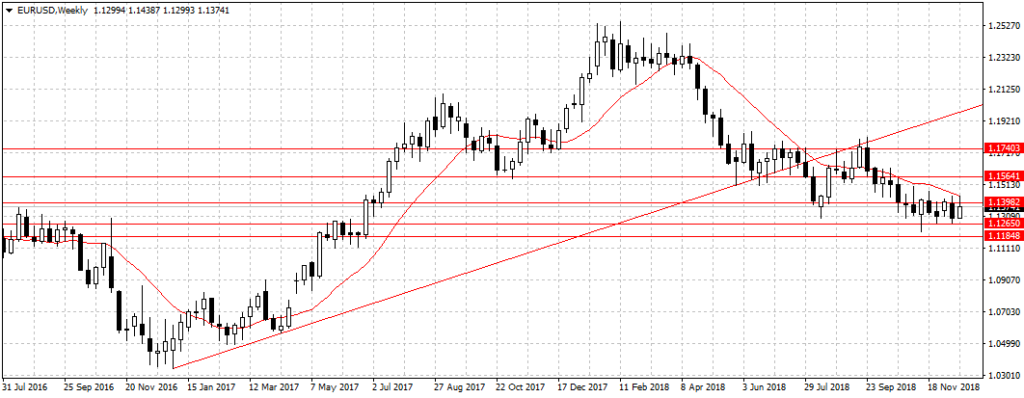

The US dollar pared losses against the Euro to 1.1378, down from 1.1438 it traded during the day.