Forex

UK Unemployment Rate Declines to 40-Year Low; Pound Falls

- UK Unemployment Rate Declines to 40-Year Low; Pound Falls

The UK unemployment rate improved in the second quarter to the lowest since the 1970s, according to the data released by the Office for National Statistics on Tuesday.

The unemployment rate improved from 4.2 percent in the first quarter to 4 percent during the period under review, economists had predicted 4.2 percent.

A total of 1.36 million people were unemployed in the quarter, 65,000 lower than the first quarter, according to ONS data. While the number of employed people in the UK rose by 42,000 during the period to 32.39 million.

However, a senior economist at Capital Economics Ruth Gregory has attributed the drop in the unemployment rate to the surge in the number of people leaving the workforce.

“Admittedly, the ILO measure of unemployment fell by 65,000, pushing the unemployment rate down to 4.0% – its lowest since 1975 – but this reflected a jump in the number of people leaving the workforce,” she stated in an email.

Meaning, while the UK’s unemployment rate may have beaten expectations, sluggish wage growth is still a concern especially with average earnings including bonuses rising just 2.4 percent (below forecasts) during the period.

“Average weekly earnings for employees in Great Britain in real terms (that is, adjusted for price inflation) increased by 0.4% excluding bonuses, and by 0.1% including bonuses, compared with a year earlier,” the ONS said.

Therefore, slow wage growth amid Brexit uncertainty may stall consumer spending and economic growth against what was projected by the Bank of England. The governor of the Bank of England Mark Carney had said emerging demands will support economic growth through the Brexit transition but with wage growth below projection and trade tensions rising, high borrowing cost may impact demands.

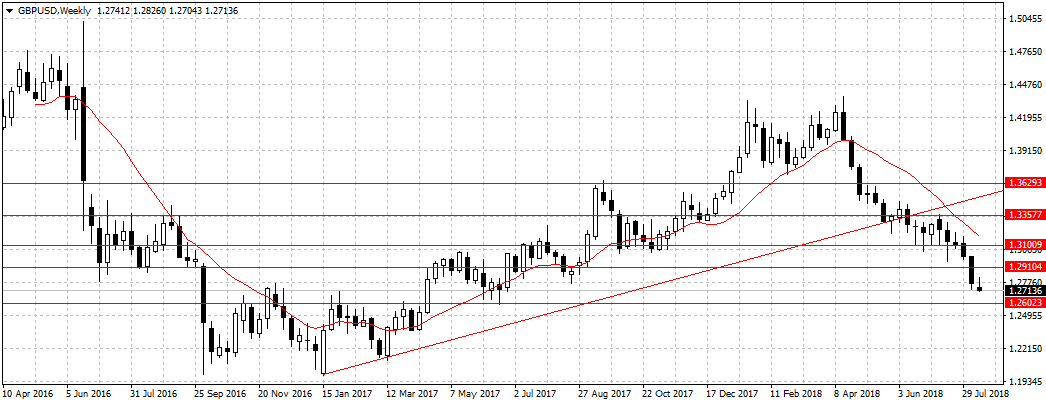

The Pound fell against the US dollar after the report to reach a 13-month low of 1.2711. As previously projected, the uncertainty surrounding the pound and the questionable timing of the rate decision will push GBPUSD towards the 1.2602 support level as more sellers jump on it.

The central bank raised interest rates from 0.5 percent to 0.75 percent earlier this month, the highest in 9 years.