Forex

UK Manufacturing Production Falls at Fastest Rate in 6 Years

- UK Manufacturing Production Falls at Fastest Rate in 6 Years

Manufacturing production in the world’s fifth-largest economy U.K. contracted in April at the fastest rate in almost six years.

Manufacturing production declined by 1.4 percent in April, worse than the 0.1 percent decline recorded in the previous month and the 0.3 percent predicted by experts, the Office for National Statistics said

Overall industrial production contracted by 0.8 percent month-on-month. Also, below the 0.2 percent projected by analysts.

“An unexpected decline in production combined with a sharp widening in the trade balance suggest the economy may not be rebounding quite as fast as the Bank of England hopes,” said James Smith, economist at ING.

According to ONS, the slowdown in production was due to persistent weakness in domestic demand coupled with slowing export orders.

Trade numbers published alongside the manufacturing numbers showed that U.K’s trade deficit widened to the largest in almost two years as exports contracted more than imports.

The total trade deficit widened from £7.8 billion in the previous month to £9.7 billion in the three months through April.

“Excluding oil and erratics, goods exports fell by 3 percent, which marked the largest three-monthly decrease since March 2016,” the ONS said.

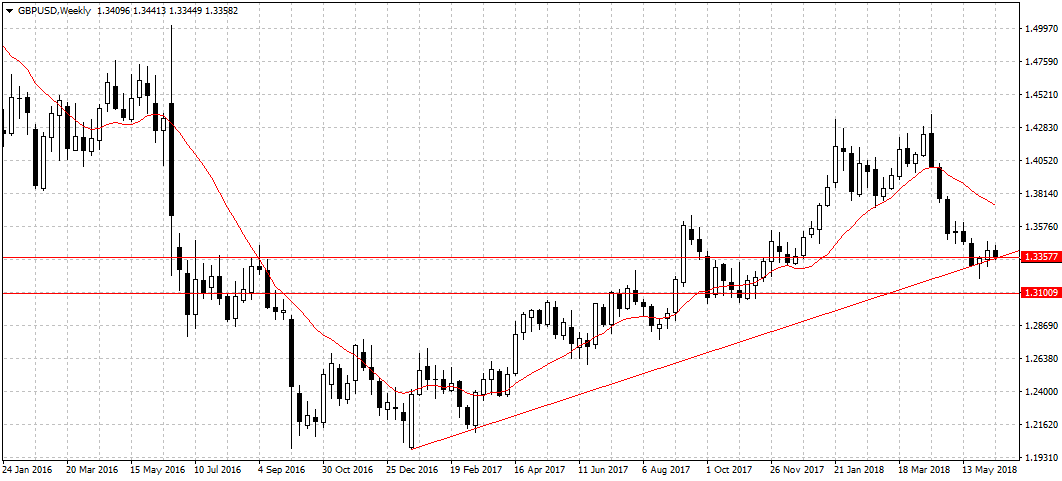

The pound dipped against the U.S. dollar to trade at 1.3359 following the report. However, with the FOMC scheduled to meet on Tuesday and projected by most experts to raise interest rates by 25 basis points. The GBPUSD pair is likely to dip below the 1.3357 support level towards 1.3100 support as traders increase their U.S. dollar holdings against the British pound.

A sustained break of 1.3357 support level should validate the continuous bearish movement started in April, and open up 1.3100 support.