Forex

U.K. Services Sector Slows in April; Pound Dips

- U.K. Services Sector Slows in April; Pound Dips

U.K. services sector joined the series of sectors that grew at a slower pace in the month of April, raising concerns about the underlying fundamental of the British economy.

The IHS Markit on Thursday said the Purchasing Managers Index stood at 52.8 in the month of April, higher than the 51.7 filed in March and the second weakest since September 2016.

The report highlighted the effect of slowing consumer spending, sluggish wage growth, and low new investment ahead of Brexit agreement and the ongoing global trade wars on the U.K. economy. Meaning, the Bank of England’s Monetary Policy Committee may not be quick to raise interest rates as widely expected this month, especially now that the manufacturing, construction, and the largest contributor, services sectors, are growing at a slower pace.

According to the chief economist at IHS Markit, Chris Williamson, the report “suggest that the underlying performance of the economy has continued to deteriorate.”

Therefore, the economy is projected to grow at a disappointing rate in the second quarter, just like the first quarter. This was after the European Union said the U.K. is likely to continue to lag growth in the euro-area and the U.S. for the next two years given its stalling new investments.

Again, despite inflationary pressures easing, job growth continued to slow across key sectors with business optimism and new orders suffering. Once again, casting doubt on November rate decision.

“Any further slowing will raise questions as to whether the November rate hike may have been ill-timed,” Williamson added.

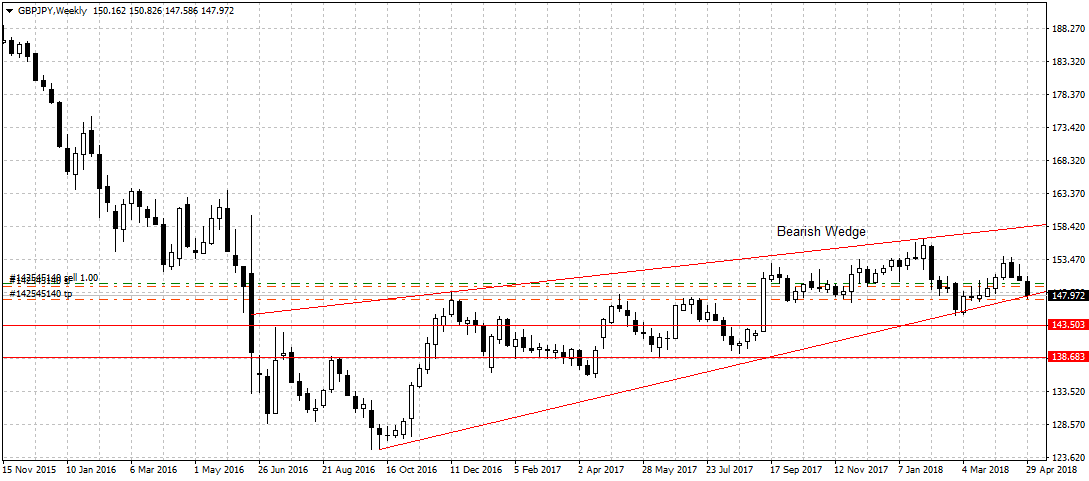

The pound fell against most of its counterparts following the report and further cast doubt on its outlook in the second quarter, especially now that the odds of the central bank raising rates this month have dropped significantly. However, we remain bearish on GBPJPY and expect a further downward movement as previously projected. A sustained break below the bearish wedge/ascending trendline should open up 143.50 support level.