Forex

Australian CPI Rises Slower in Q1

- Australian CPI Rises Slower in Q1

Australian cost of goods and services rose less than forecast in the first quarter of the year, the Australian Bureau of Statistics (ABS) reported on Tuesday.

The Consumer Price Index, which measures inflation rate rose by 0.4 percent in the quarter, slightly below the 0.5 percent predicted by most experts and 0.6 percent recorded in the final quarter of 2017.

On a yearly basis, inflation rate climbed by 1.9 percent, below the RBA’s 2 percent target. While the most significant price increase in the quarter was seen in the pharmaceutical products that rose by 5.6 percent, gas and other household fuels that climbed by 6 percent.

The report was in line with Governor Philip Lowe’s projection that inflation will gradually return to the midpoint of the central bank’s 2 percent to 3 percent target amid weak price pressure that is hurting developed nations.

However, policy-makers believe record-low interest rates will boost hiring and further tighten the job market, which in turn will bolster wage growth and pressure prices.

The Australian dollar dipped against the U.S dollar following surged in the greenback to a three month high. Suggesting that the Reserve Bank of Australia is likely to keep the interest rate on hold this year.

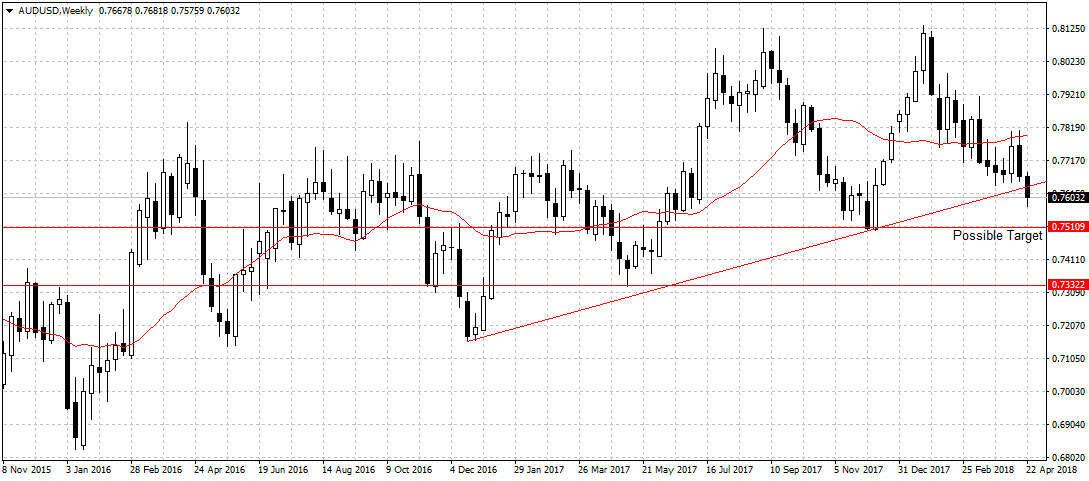

Therefore, with the odds of RBA raising rates this year declining amid weak wage growth and low price pressures, I will expect the AUDUSD to continue its bearish move started in January 2018 for 0.7510 price level. A sustained break of that support level should open up 0.73322 supports.