Forex

Euro-Area Consumer Prices Surge in March

- Euro-Area Consumer Prices Surge in March

Consumer prices in the Euro-area accelerated in March, further supporting European Central Bank’s decision to commence balance sheet normalization later in 2018.

The Consumer Price Index, which measures inflation rose 1.4 percent in March, the largest jump since the end of 2017 and better than the 1.1 percent recorded in February.

Since the European Central Bank cut interest rates below zero in more than 3 years ago and started its quantitative easing program to support the economy, the inflation rate is finally returning to the apex bank’s 2 percent target.

Therefore, fueling a debate on how the apex bank plan to scale back support and raise interest rates like its counterparts, especially now that the economy is growing at the fastest pace in a decade and unemployment improving to a nine-year low of 8.5 percent in February.

However, officials believe it is likely the central bank end asset purchase program in December and hike rate by the middle of 2019.

“Underlying inflation is likely to accelerate eventually. The economy of the monetary union has almost completely healed from the euro crisis and the erosion of spare capacity should eventually put upward pressure on wages. The expectation for those price pressures from the labor market to increase should be enough for the ECB to continue paring back its monthly asset purchases,” said David Powell and Jamie Murray, Bloomberg Economics.

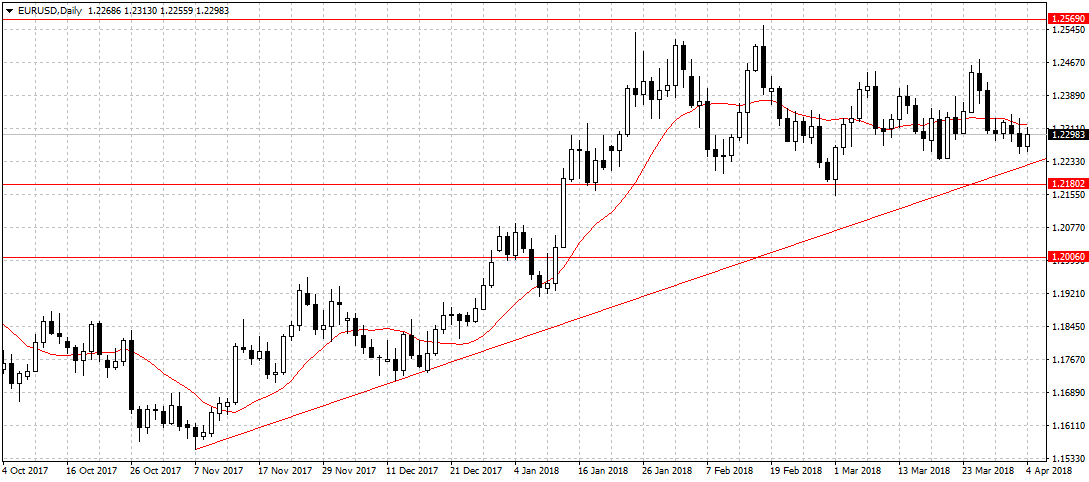

The Euro gained slightly against the U.S. dollar to trade at $1.2298.