Forex

U.K. Construction PMI Inches Higher in February

- U.K. Construction PMI Inches Higher in February

Business activity in the UK construction sector inched higher in February despite rising input cost.

The construction Purchasing Managers’ Index climbed from January’s 4-month low of 50.2 to 51.4 in February, IHS Markit reported on Friday. This indicated a slight increase in construction activities during the month, but lower than the 2017 average of 52.3.

Similarly, input inflation remained strong, driven mainly by the high cost of raw materials, fuel costs and wages. According to the report, while the increase in costs pushed operating expenses up in the month, input cost inflation was much softer than the five and a half year peak recorded at the start of 2017.

However, rising Brexit uncertainty continued to hurt new investment as new business volume fell in February on fragile client confidence and lack of tender opportunities to replace completed work on infrastructure projects.

Low business activity and weak new orders also weighed on input purchase during the month, even though it helped alleviate some of the supply chains’ challenges reported in the manufacturing PMI released on Thursday.

Duncan Brock, Director of Customer Relationships at the Chartered Institute of Procurement and Supply, said: “The sector was feeling as flat as a pancake in February with falls in new orders for the second month in a row and with just a marginal rise in overall activity, as ongoing political and economic uncertainty shouldered the blame.

Meanwhile, Prime Minister Theresa May is scheduled to detail how the U.K. plans to exit the European Union and build business confidence ahead of Brexit negotiation. Businesses and investors are waiting to deduce economic direction from the speech, especially after data showed manufacturing PMI declined in February and President Donald Trump announced possible tariffs increment on import steel and aluminum.

The pound rebounded against the U.S dollar as projected following President Trump’s statement on tariffs but extended its decline against the Japanese yen.

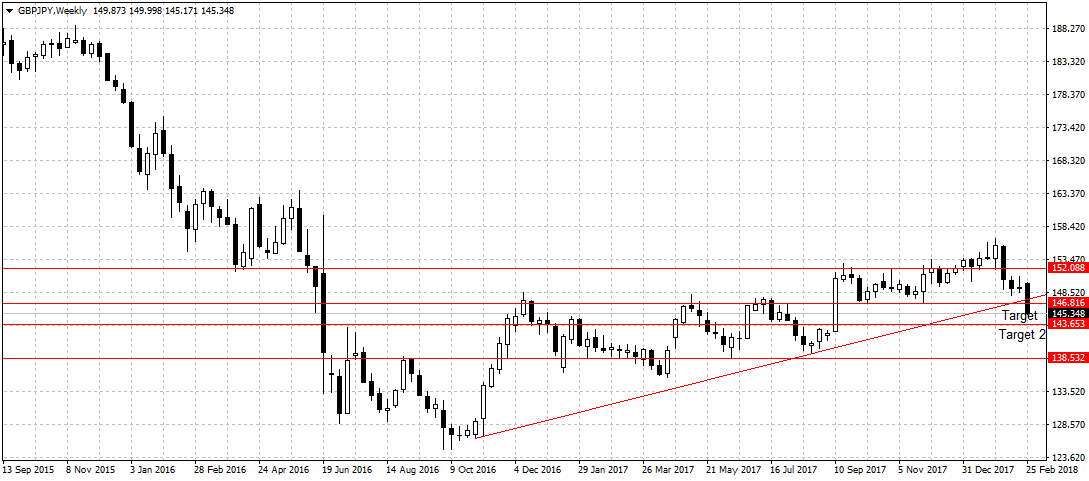

After GBPJPY closed below our weekly target at 146.81, the yen surged further on BOJ’s statement that the central bank will start looking into balance sheet normalization in 2019. While this does not confirm potential rate hike in 2019, the markets believe the possibility is there giving all the fundamentals.

Therefore, we expect the strong yen attractiveness due to U.S. uncertainty and weak pound fundamentals to push GBPJPY down to 143.65 as projected yesterday.