Forex

U.K. Services Expands at 16-Month Low

- U.K. Services Expands at 16-Month Low

The U.K. services sector expanded at the slowest rate since September 2016 in January, following the drop in new orders and high price pressures.

According to Markit, the Services Purchasing Managers’ Index stood at 53 in January, down from 54.2 in December, the lowest in 16 months. The weaker than expected growth in the services sector was attributed to the uncertainty surrounding the Brexit as investors look to decipher U.K.’s economic direction in 2018.

Duncan Brock, the Director of Customer Relationships at the Chartered Institute of Procurement & Supply, said: “Brexit blame has emerged once again as the reason for the slowdown in the growth of services activity, which was at its lowest since September 2016 as consumers reined in spending and displayed anxieties about the future.”

Despite the drop in business activity, new business inflow increased slightly faster in January, however, the overall rate of growth was slower when compared to 2017 average.

Businesses in the sector sustained job creation in the month, with job creation now growing continuously for one and half years. The rate of job creation in January rose to four-month high, suggesting businesses were retaining workers as positive output expectations surged. Business confidence climbed to its strongest since March 2017.

Chris Williamson, Chief Business Economist at IHS Markit, which compiles the survey said: “The softer service sector growth follows news of the manufacturing upturn losing momentum at the start of the year and a near-stagnant construction sector. All together, the PMI surveys point to the slowest pace of expansion since August 2016.”

Speaking further, Chris said the weak PMI readings in January point to the economic growth rate of 0.3 percent in the fourth quarter despite the fact that fourth-quarter PMI readings were historically consistent with the growth rate of 0.4-0.5 percent. According to him, the January slowdown pushes all-sector PMI into dovish territory as far as Bank of England monetary policy is concerned and with the survey indicating weaker price pressures, the data cast doubt on any imminent interest rate hike.

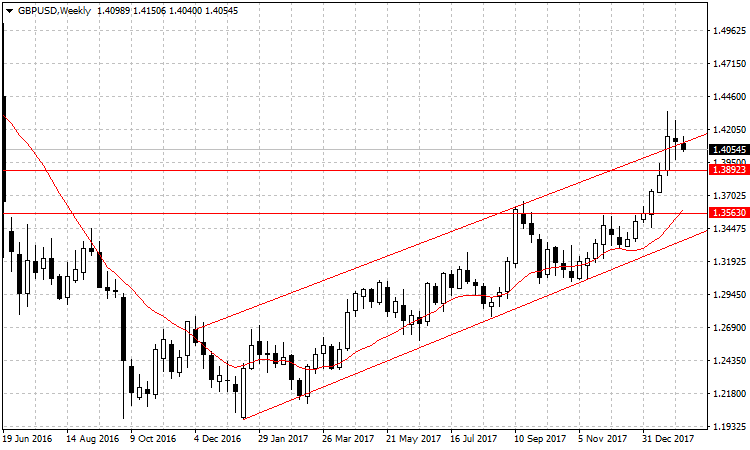

The pound sterling dropped against the greenback to $1.4051, up from up from $1.4345 recorded three weeks ago. A break of $1.3892 support level should validate bearish pressure and open up $1.3563 support.