Forex

U.K. Services PMI Beats Expectation; Pound Stable

- U.K. Services PMI Beats Expectation; Pound Stable

The United Kingdom services sector grew faster than expected last month following similar result from manufacturing and construction sectors.

The Services Purchasing Managers’ Index (PMI) climbed to 55.6 in October, up from 53.6 in September, according to the IHS Markit report released on Friday. The highest level since April and the biggest one month jump since August 2016.

Also, this is better than the 53.3 predicted by most economists and higher than the 50 mark that separates expansion from contraction.

This is coming a day after similar upbeat PMI numbers were recorded in the construction and manufacturing sectors in October.

According to IHS Markit, the series of positive growth from these sectors suggested that the economy is growing at a quarterly rate of 0.5 percent. This is better than the 0.4 percent recorded in the third quarter and if sustained, the annual economic growth rate should rise from the four-year low of 1.5 percent recorded in the second and third quarters of 2017.

Businesses were unsure about the economic outlook, and optimism among services firms remained below its long-run average. This, Markit attributed to Brexit uncertainty.

Meanwhile, the Bank of England raised interest rates for the first time in more than a decade on Thursday, the benchmark rate increased by 25 basis points to 0.5 percent, up from 0.25 percent.

Governor Mark Carney during press conference said the economy remains fragile and expect Brexit to further impact economic outlook going forward.

“While an upturn in business activity growth adds some justification to the Bank of England’ decision to hike interest rates … a deeper dive into the numbers highlights the fragility of the economy,” said Chris Williamson, the chief business economist at IHS Markit, which compiles the PMIs.

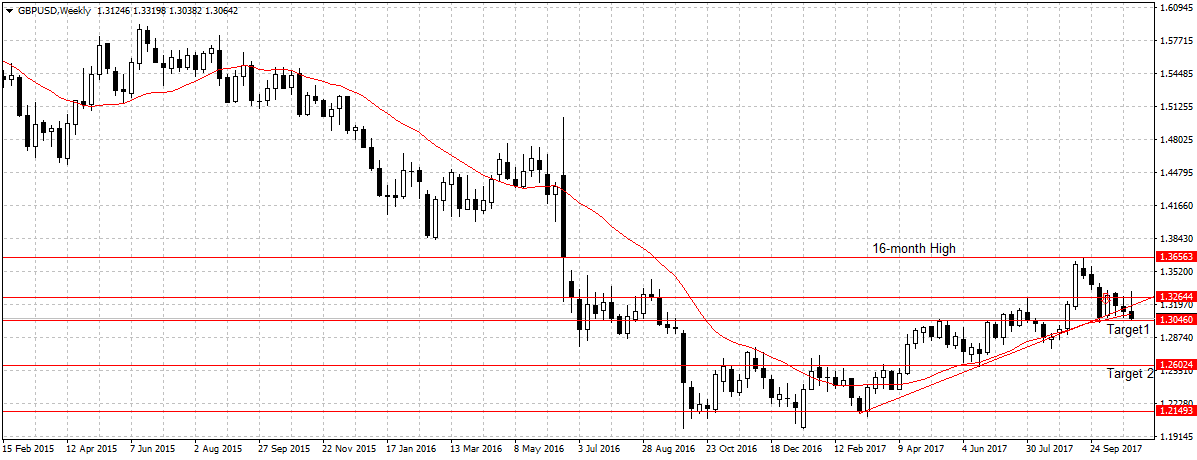

The Pound remains fairly stable, trading at $1.3063 against the US dollar.

But as projected in the previous analysis, a sustained break below the 1.3046 support level, target 1. Should open up 1.2602 support in coming days. Especially, now that the odds of 2018 rates hike are low.