Forex

AUDJPY Weekly Outlook October 30 – November 3

- AUDJPY Weekly Outlook October 30 – November 3

The weak Australian fundamental and China’s deleveraging effort plunged the Aussie against most currencies.

However, the Japanese Yen standout because of its stability and renewed interest in the Japanese economy since Prime Minister Shinzo Abe won his re-election in October.

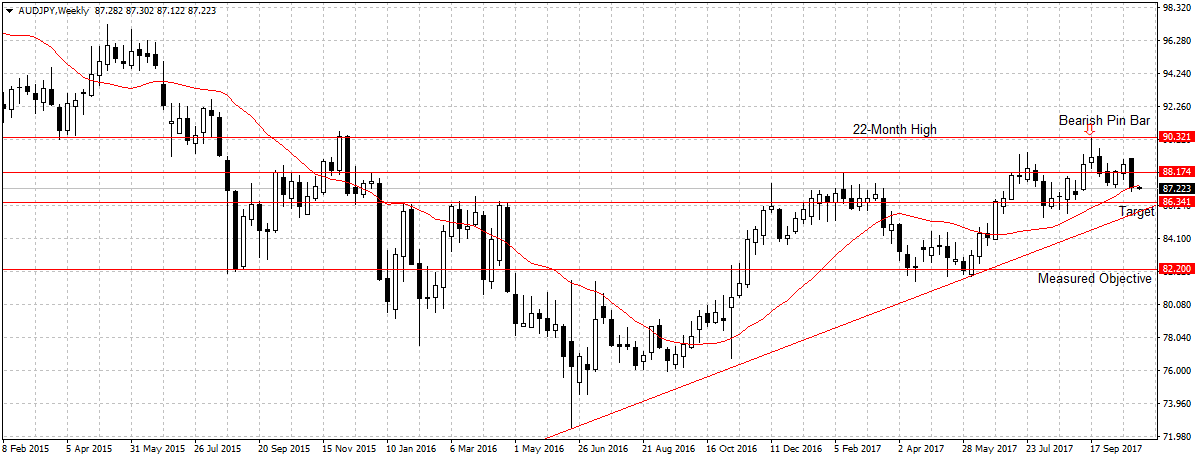

Since I first mentioned this pair sell opportunity in mid-October, it has dropped 92 pips to close below 88.17 price level and 20-day moving average. Suggesting that investors are concern about the impact of rising household debt and weak wage growth on Australia’s consumer spending going forward.

Also, while the strong Australian job market has failed to boost consumers’ earnings. It is projected to slow down in the first half of 2018, especially in the mining sector, when China is expected to cut Iron Ore importation to curb extreme pollution and institute tough credit control measures to contain escalating business debt. China is Australia’s largest trading partner.

Japan, on the other hand, continued to sustain growth through improved exports and increased productivity that saw the economy growing at 2.6 percent rate in the second quarter despite weak wage growth.

This, boost Yen attractiveness even though the Bank of Japan’s Governor Haruhiko Kuroda insisted on maintaining the current monetary policy to further stimulate the economy and contain foreign exchange rate.

Technically, I do not see AUDJPY topping its 22-month high this year for two main reasons, one the Australian economic fundamentals are below expectations, forcing the Reserve Bank of Australia to leave interest rate unchanged in October. Two, China has capped importation of Iron Ore, one of Australia’s largest export. This is a huge setback for a commodity-dependent currency like the Aussie dollar.

Therefore, as long as price remains below the 88.17 I will continue to add to my sell position for 86.34 targets. A sustained break below the ascending trendline should open up 84.10 support. Hence, I remain bearish on this pair as stated previously.

While the currency has been favoured by growing uncertainties and improved global economic outlook, the Aussie dollar remained overpriced as stated previously and expected to dip against strong currencies like the Japanese yen, backed by strong and growing economic fundamental. An excerpt from forex weekly outlook of Oct 16-20.