Forex

Forex Weekly Outlook October 2-6

- Forex Weekly Outlook October 2-6

The US dollar rebounded last week after Janet Yellen said gradual interest rate hike is appropriate at a time of high uncertainty and that it would be imprudent to keep monetary policy on hold until inflation reach 2 percent target. This aided the attractiveness of the greenback to gain almost 1 percent last week, making it the first monthly gain against its peers since February.

Also, while consumer confidence dipped to 119.8 in September and consumer spending rose just 0.1 percent in August with earnings climbing 0.2 percent, lower than the 0.3 percent recorded in July. The economy remains healthy as the second quarter economic growth rate was revised up to 3.1 percent, from 3.0 percent previously reported. Suggesting the economy is growing at a healthy pace and far better when compared to the U.K. that grew at 0.3 percent and the Euro-area confronted with far-right in Germany and separatists pushing for secession in Spain.

This week AUDUSD, CADCHF, NZDUSD and USDJPY top my list.

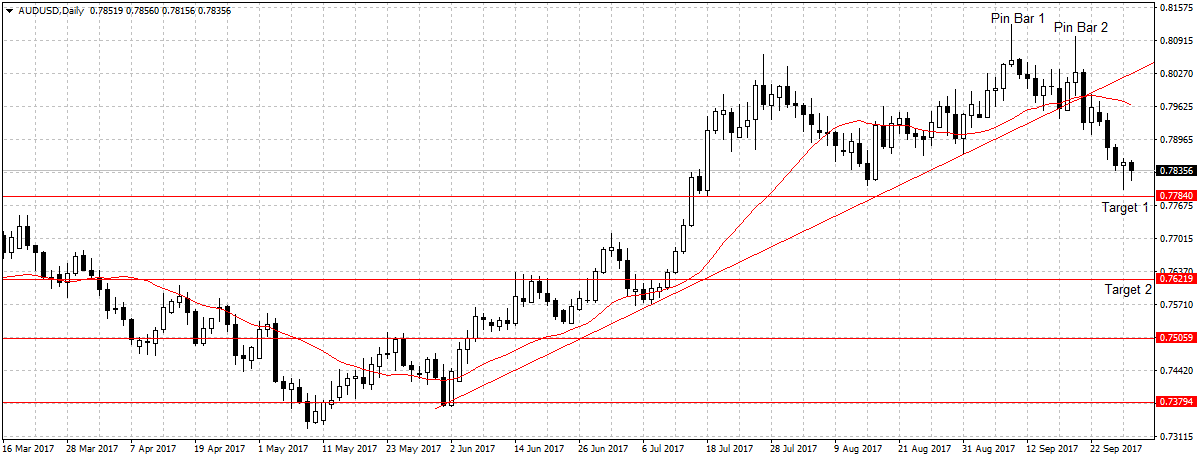

AUDUSD

In Australia, fall in global iron ore weighed on the economy and plunged the Australian dollar to its lowest in two months against the U.S. dollar. Since late August, the Australia’s number one export commodity has fallen by 25 percent and expected to dip even further following restrictions on Chinese steel mills, less expansionary fiscal policy and tighter credit conditions. Most experts projected slow economic growth for China, Australia’s largest trading partner. Meaning commodity prices, especially the metal prices are facing a more uncertain outlook going forward as demand for iron ore in Tangshan city, the biggest steel hub in China, has been reduced by half from November to March to better contain extreme pollution during the winter period.

Again, the Australian dollar has been overpriced for a while as stated in the previous analysis and according to the Reserve Bank of Australia governor Philip Lowe higher foreign exchange rate would hurt economic competitiveness of the nation and affect exports. Therefore, while plunged in the Australian dollar will boost exports of farm produce and other non-metal commodity products, it would have no meaningful impact on total exports and weigh on wage growth of workers in the mining sector.

Technically, the two pin bars signifies lower highs, a bearish move validation. But the AUDUSD failed to close below the 0.7820 support level to reaffirm bearish continuation, especially after Thursday pullback, due to weak consumer spending and wage growth report in the US. However, as more sellers jump on this pair this week I will expect a further decline of the AUDUSD given the aforementioned reasons and a sustained break of 0.7784 levels, our target two weeks ago, to open up 0.7621 targets as shown above.

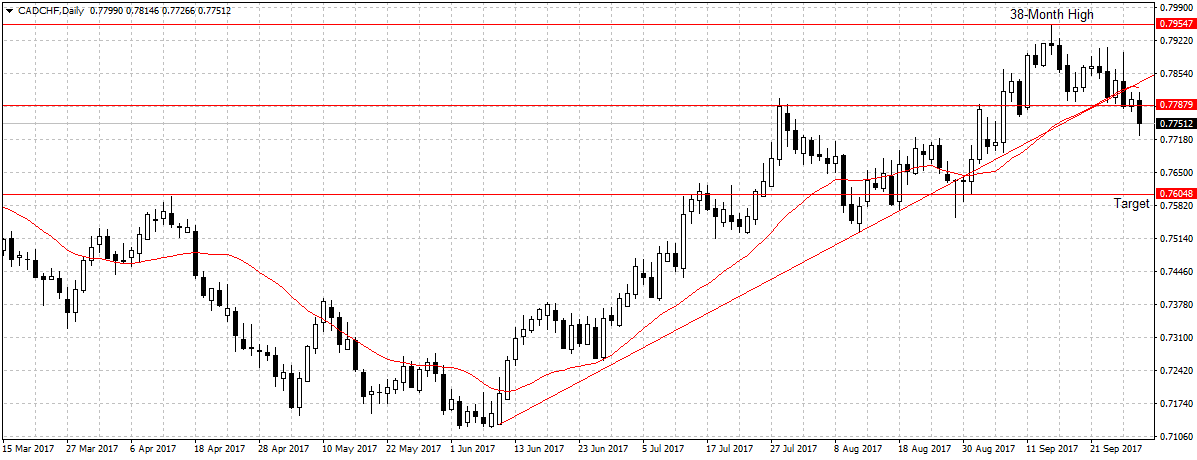

CADCHF

The Canadian dollar outlook has been aided by improved economic outlook, growing manufacturing sector, and strong labour market. So far the economy has expanded for eight consecutive months before going flat in July due to the contraction of 9 out of 20 industries surveyed in the month. Also, the Bank of Canada raised rates twice this year and projected to hike again as early as first half of 2018.

While the Swiss Franc on the other hand, is weighed upon by loose monetary policy. The Swiss National Bank has long said its currency is overpriced, meaning it’s not likely to tighten its monetary policy anytime soon. But the growing political uncertainty in the Euro-area could bolster Swiss Franc attractiveness as investors are risk-averse.

Technically, this pair has lost 203 pips since peaking at 0.7955 price level on September 14, its highest in 38 months. However, after closing below the 20-day moving average and key support level, 0.7787, the new resistance. This pair confirmed bearish continuation and I will expect the surge in the Canadian dollar attractiveness this week to further aid this pair towards 0.7604 targets. Therefore, I am bearish on this pair this week and will be looking to sell below 0.7787 for 0.7604 targets.

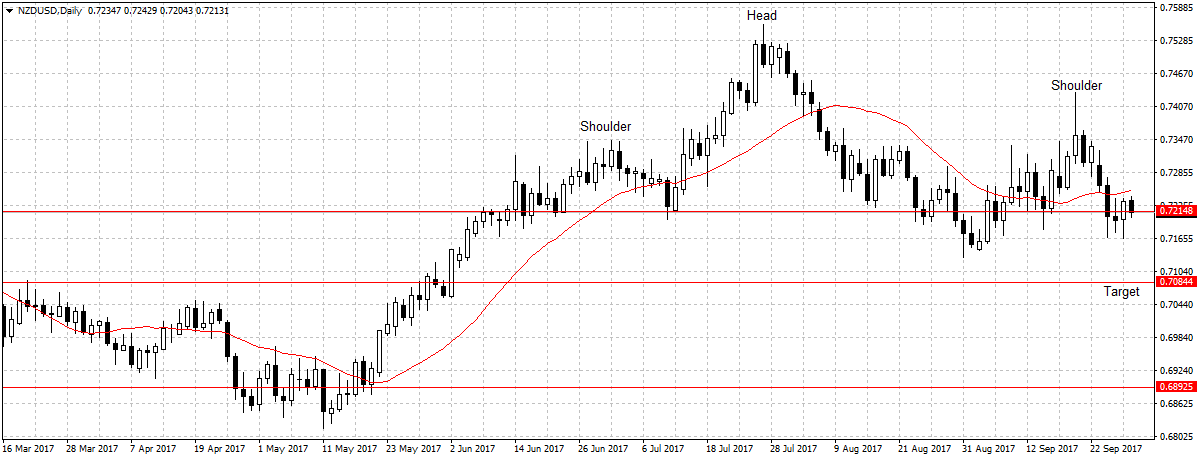

NZDUSD

While the growing uncertainties and rush for haven assets has helped the attractiveness of the Kiwi in recent time. The projected slowdown in the Chinese economy will hurt New Zealand exports and overall economic growth going forward. This is because China is the largest New Zealand trading partner in goods while the Australia, predicted to also be affected by the slowdown, is New Zealand’s overall largest trading partner in goods and services. Indicating that New Zealand trade balance would be affected in the long-term and so will economic growth.

Since the New Zealand dollar rose to more than 2-year high in June at the height of North Korea and U.S. missile tension, the pair has lost 344 pips. Meaning the Kiwi gains has been mainly fueled by the rush for haven assets as a risk aversion tool and not because of its strong fundamentals. While the US dollar is not weak, the uncertainty and inability of Donald Trump to push through with the tax reforms yet is hurting the greenback attractiveness. However, with the Janet Yellen statement that the Federal Reserve shouldn’t wait for inflation to meet 2 percent target before unwinding its $4.5 trillion stimulus. The dollar outlook changed.

Technically, this pair complete its head and shoulders pattern started in June last week. Another confirmation of bearish continuation. Therefore, this week I am bearish on this pair and will be looking to sell below the 0.7214 price level for 0.7084 targets.

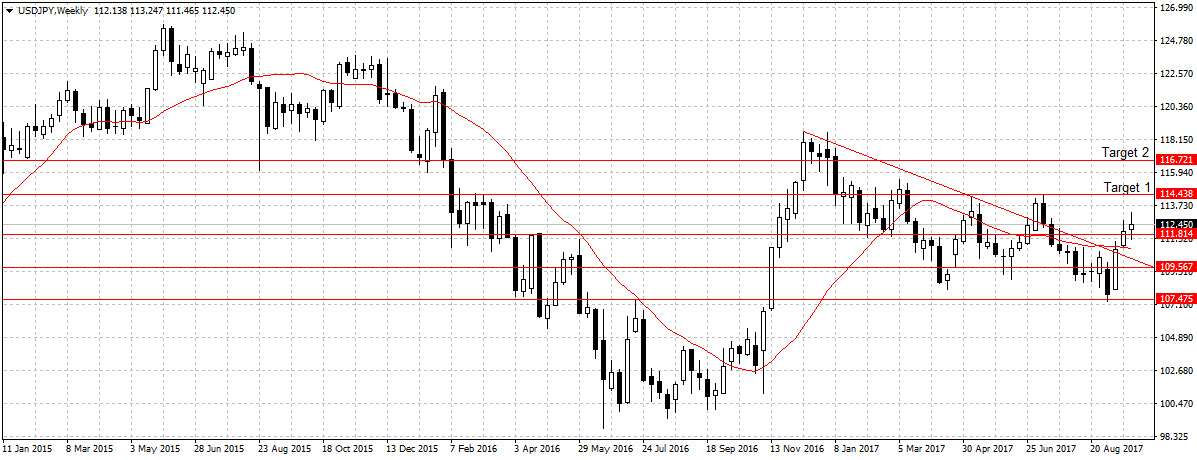

USDJPY

Since this pair breaks 111.81 two weeks ago, it has sustained it. Thanks to the October 22 Japanese snap election and Federal Reserve positive economic projection.

But the fast-rising Tokyo Gov. Yuriko Koike’s new national party is disrupting currency market as investors are wary of what a strong showing by the party might mean for the current monetary policy, intentionally let loose to keep the Yen weak. This is to avoid what happened in Germany and France as parties in power have suffered one form of defeat or the other in recent time.

Therefore, this week I will expect uncertainty to weigh on Japanese Yen attractiveness and the renewed U.S. economic outlook to boost the dollar attractiveness against the Yen to 114.43. This week I will be looking to buy this pair above the 111.81 price level for 114.43 targets.