Forex

AUDUSD on the Move Following Drop in Commodity Prices

- AUDUSD on the Move Following Drop in Commodity Prices

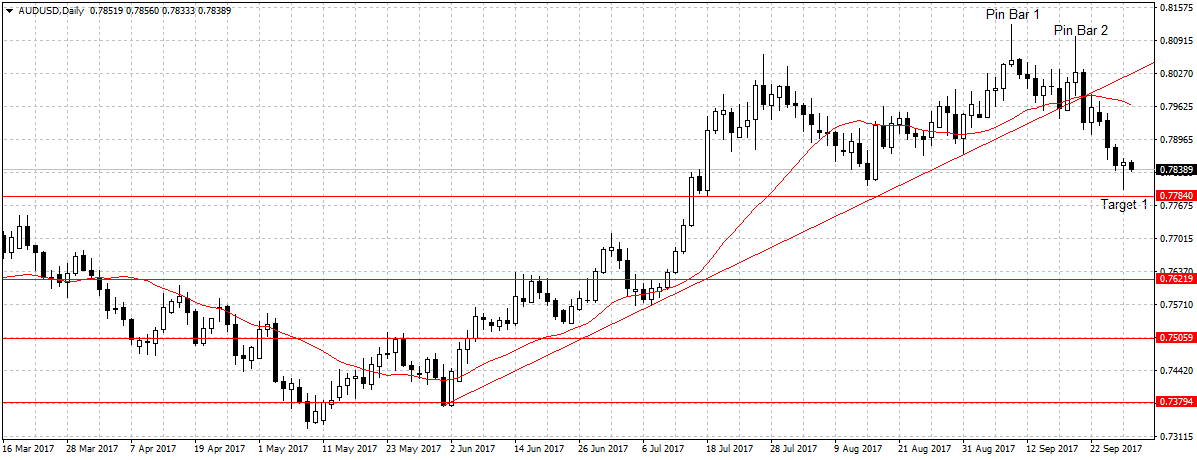

As explained in the forex weekly outlook, a break below the ascending trend line will reinforce sellers’ interest and further aid price towards our 0.7764 targets.

Again, while the uncertainties surrounding tax cut and North Korea missile threat are weighing on the US dollar outlook. The Australian dollar, on the other hand, is overpriced and likely to remain less attractive in coming days. An excerpt from FX weekly outlook of September 18-22.

However, the strong U.S. dollar and plunged in the Chinese commodity prices, Australian largest trading partner, dipped this pair this week. But the uncertainties remain, especially the possibility of Donald Trump not delivering on proposed tax reforms might halt progress. The reason for quick Thursday rebound.

“In our view, USD will continue to trade on the defensive until we have more details on the proposed tax reform impact on US fiscal policy and foreign capital flows to the US,” said Elias Haddad, senior currency strategist at the Commonwealth Bank. “Also, the legislative process to get tax reform passed by Congress will most likely take some time.”

Drop in the prices of Iron Ore is impacting Australian dollar performance and will continue even with a moderate U.S. dollar strength.

“AUD will largely ignore the release of Australia’s August private sector credit report,” Haddad says. “Instead, AUD/USD will continue to be guided by the performance of iron ore prices and the USD.”

Therefore, we remain bearish on AUDUSD and expect a sustained break of 0.7784 targets to open up 0.7621 support level in days to come. The Australian dollar is overpriced, and as stated by the Governor of Reserve Bank of Australia, Philip Lowe, high foreign exchange rates would hurt economic progress.