Finance

China, Nigeria, Others Push Global debt to a Record High of $217 Trillion

- China, Nigeria, Others Push Global debt to a Record High of $217 Trillion

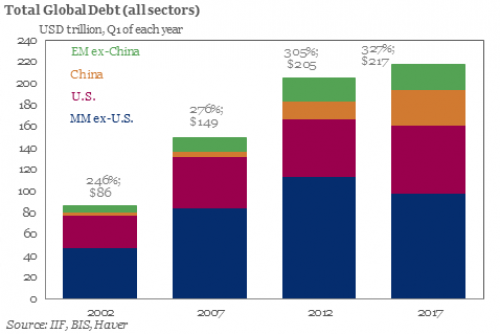

Global debt rose to a new all-time high of $217 trillion in the first quarter of 2017, according to the Institute of International Finance.

The institute said global borrowing hit 327 percent of the world’s gross domestic product (GDP) after data showed emerging market borrowing surged by $3 trillion to $56 trillion.

Making it 218 percent of emerging economies combined GDP and 5 percent higher than the first quarter of 2016.

China’s debt stood out of the entire emerging economies, rising by $2 trillion to $33 trillion. While the rest added $1 trillion.

Similarly, Nigeria’s external debt rose by $4.4 billion or 46 percent from $9.46 billion to $13.81 billion in 2107. While domestic debt climbed by N3.46tn or 40.71 percent to N11.97 trillion in 2017 from N8.51 trillion. Bringing the total debt to N19.2 trillion record high.

The report further revealed that while developed nations cut their total debt by over $2 trillion in the past year, emerging economies are adding more debts.

“Rising debt may create headwinds for long-term growth and eventually pose risks for financial stability,” the report stated.

“In some cases, this sharp debt build-up has already started to become a drag on sovereign credit profiles, including in countries such as China and Canada.”

Highlighting the danger of rising global debt, Samed Olukoya, a foreign exchange research analyst at Investors King Ltd said: “With rising interest rates in the U.S, and the European Central Bank announcing its readiness to unwind its quantitative easing program with possibility of a rate hike as early as the third quarter, global cost of borrowing would surge and stall new job creation and earnings if global debt is not checked.”

So far, the Federal Government has spent over N500bn (N474bn and $127.9m) to service both domestic and external debts in the first quarter of 2017.