Forex

Forex Weekly Outlook April 24-28

- Forex Weekly Outlook April 24-28

The US dollar plunged against most of its counterparts last week following worse than expected economic data. The retail sales, consumer spending, which has been supporting the economy fell (-0.2%) for a second month after a 0.3 percent decline in February. Indicating that the economy is probably not ripe or ready for a June rate hike as that would worsen retail sales and further plunged consumer spending while dragging the seemingly weak inflation (-0.3%) along.

However, if Donald Trump’s tax plan due this week is well-received and projected to boost infrastructure, the U.S. market would experience renewed confidence and surge in the U.S. dollar and currencies of commodity-dependent economies as demand for steel to build ports, bridges and roads will drive demand for iron ore.

In the Euro-area, the economy accelerated to its fastest pace in 6 years in April. Signaling that the manufacturing and services sectors are growing better than previously anticipated –this is after data showed both the purchasing manager index for manufacturing and services sectors rose from 56.4 in March to 56.7 in April. But a Le Pen win in French election could deal a blow to the current progress as a call for Frexit would not merely tear the struggling region apart but forced other nations within the union to secede.

Therefore, in an effort to curtail eventualities, the European Central Bank officials have signalled their readiness to support commercial banks in the region to counter market tension that may arise as both the centrist Emmanuel Macron and the far-right leader Marine Le Pen face-off on May 7.

In the U.K., the economy has started showing signs of Brexit effect after data revealed retail sales plunged 1.8 percent in March alone. Plunging total sales to 7-year low in the first quarter of the year. Also, the manufacturing and construction sectors contracted in February, while house price growth slowed to its weakest in 4 years. This further underscores the loss of economic momentum ahead of June 8 election.

Generally, uncertainty remains high across global financial markets this week. Therefore, high volatility should be expected across the board — especially on Wednesday when President Donald Trump is expected to announce his tax plan. Also, the conundrum going on in the Euro-area continued to create doubt as to the future of the region and has started weighing on business sentiment as investors look to decipher political-tussle going on in France.

This week, I will be looking at EURGBP and AUDJPY.

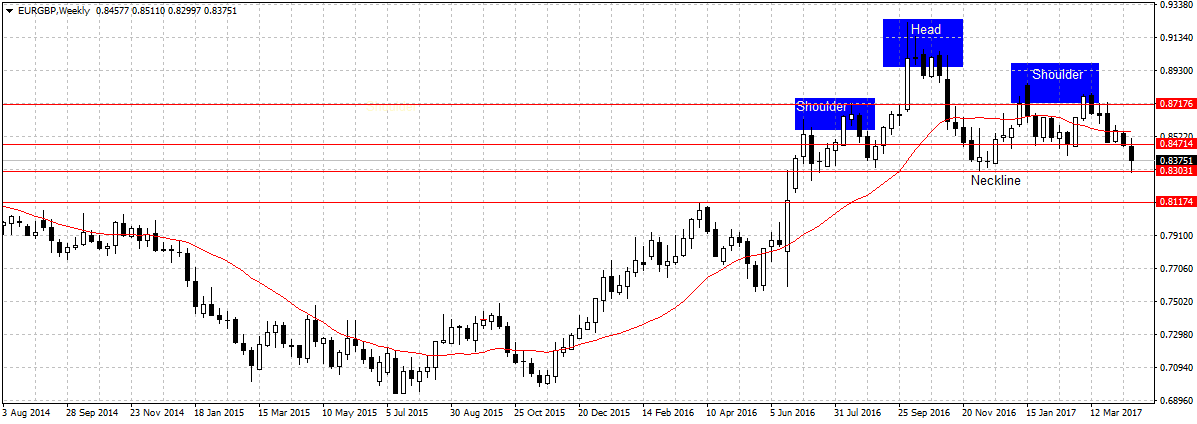

EURGBP

This pair is unique for two reasons, one after forming head and shoulders pattern it has failed to break below the neckline at 0.8303 support levels since June. Two, the political tussle going on in the Euro-area is self-directory for this pair. Meaning it will dictate its future direction.

Accordingly, an Emmanuel Macron overwhelming support ahead of May 7 would buttress EURGBP rally as it would guaranty France membership in the European Union to investors and further position the nation as the next financial power-house after Brexit. However, Le Pen lead would weaken the Euro-single currency as businesses and investors look to minimise risk exposure by cutting new jobs and whining down on investments amid weak business sentiment.

Therefore, I will be looking to buy this pair above 0.8471 resistance level if Macron increases his lead substantially. This is because the pound is weak and can only get worse ahead of June 8 election going by the series of recently release economic data that shows the consumer spending that contributed the most to the U.K. economy has started slowing down. Also, the Euro-area economy is growing stronger than previously anticipated and surged to a 6-year high. But if Le Pen increased her current position significantly I would be looking to sell as that would have nullified other factors stated above and paved way for massive sell-off of the Euro-single currency.

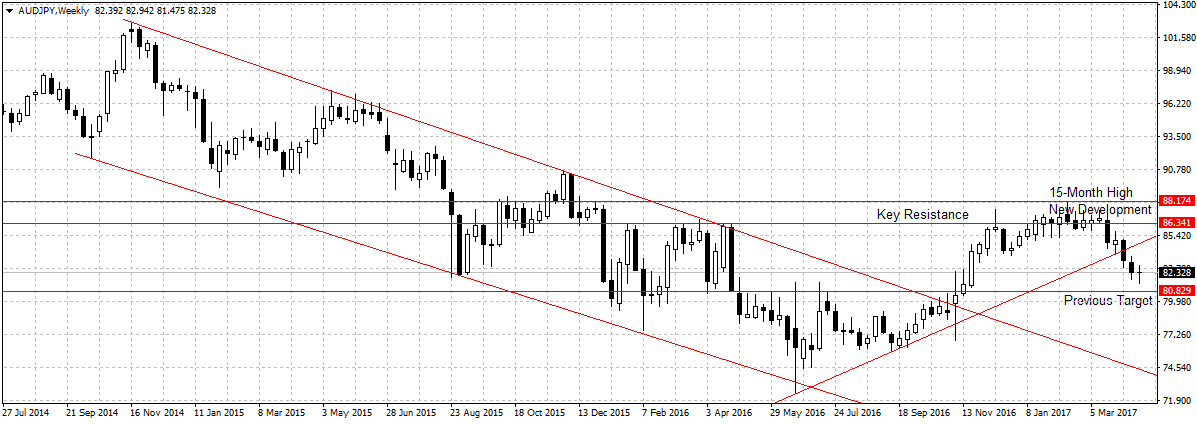

AUDJPY

This pair closed as dragonfly doji last week after failing to hit our target at 80.82 support levels. But with Donald Trump tax plan due on Wednesday there is possibility of this pair rallying up if the tax plan is widely accepted — as it would bolster Australia’s economic outlook and aid Aussie dollar attractiveness along with a surge in global iron ore prices.

Therefore, I will be standing aside to better monitor price action along with the U.S. fiscal policy. One because I do not see this pair breaking 85.42 resistance levels that double as 20-day moving average or topple 15-month high at 88.17 resistance. However, I will look to sell this pair peradventure tax plan failed to meet expectation like previous Donald Trump fiscal policies with 80.82 support (previous target) as the target.

Happy New Week.