Forex

World’s No. 2 Currency Trader Says Dollar Rebound Just the Start

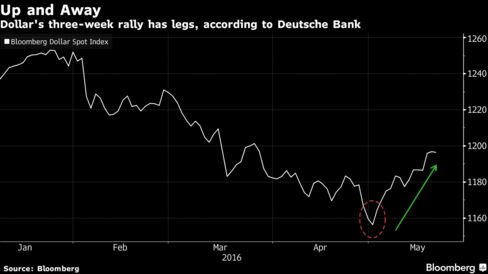

The dollar’s three-week rally is just the beginning, according to Deutsche Bank AG.

A slump by the greenback earlier this year has “likely run its course,” analysts at the world’s second-largest currency trader wrote in a note Friday. The bank favors buying the U.S. currency versus emerging markets — such as China, Mexico and South Korea — following a shakeout in speculative bets on the dollar, George Saravelos, co-head of global foreign-exchange research in London, wrote.

With policy makers from the Group-of-Seven economies meeting in Japan, the Federal Reserve this week gave the dollar a boost by signaling that it may raise interest rates as soon as June. That helped send the greenback to a seven-week high, providing relief to policy makers outside the U.S. who have watched with dismay as a weaker dollar eroded the stimulatory effect of interest-rate cuts and bond purchases.

The Bloomberg Dollar Spot Index, which tracks the dollar versus 10 peers, added 0.8 percent this week. The greenback rose 0.8 percent to $1.1224 per euro and gained 1.4 percent to 110.15 yen.

Market Swings

The dollar slumped 12 percent versus the yen, 7 percent versus the euro, and 7 percent against 10 peers this year before turning higher this month.

More neutral positioning signals room for dollar gains. Hedge funds and other large speculators cutting bets against the dollar this week after turning net bearish on the currency for the first time since 2014 at the end of April, data from the Commodity Futures Trading Commission show.

“The dollar cycle isn’t old enough to die of old age,” Saravelos wrote. “Recent weakness has likely run its course.”

For Deutsche Bank, the dollar’s biggest gains will be versus emerging markets, partly because they rely less on Fed expectations.

New York and Richmond Fed presidents both indicated this week that the central bank may look to raise rates as soon as June — a message also hinted at in minutes from its last meeting. Markets are pricing just a 30 percent likelihood of a hike next month and a 73 percent by the end of the year.

State Street Corp., with about $2.3 trillion under management, agrees. Emerging markets are likely to slump versus the dollar, while the performance of the greenback versus the euro and yen depends on the Fed.

“The dollar does go up against risky assets,” Lee Ferridge, the Boston-based head of macro strategy for North America at State Street Global Markets, said in an interview at Bloomberg’s New York headquarters. “But for euro and yen, it’s much more subtle now because that’s about policy divergence.”